An investment company managed by

DMX Asset Management Limited

ACN 169 381 908 AFSL 459 120

13/111 Elizabeth Street, Sydney, NSW 2000

DMXCP directors

Roger Collison, Dean Morel, Steven McCarthy

Opening NAV (30 July 2023)

$2.3710

Closing NAV (31 Aug 2023)

$2.3490

Fund size (gross assets)

$23m

% cash held - month end

2%

1-month return

-0.9%

1-year return

-3.5%

3-year return (pa.)

11.3%

Since inception (8 years 4 months) (pa.)

15.4%

Since inception (8 years 4 months)

232.2%

Dear Shareholder,

DMXCP’s NAV decreased 0.9% (after all accrued management fees and expenses) for August 2023. The NAV as at 31 August 2023 was $2.3490 compared to $2.3710 as at 31 July 2023.

Markets declined during August – the All Ordinaries fell 1.4% while the Small Ordinaries declined 1.6%. Pressure on smaller companies continued with the Emerging Companies Index falling 4.3%.

August Reporting

August saw our companies report their results for the 12 months to 30 June 2023. Whilst a number of our companies had pre-reported their results, we were keen to get a sense as to how the portfolio has been navigating the deteriorating macroeconomic conditions and get a better understanding of the outlooks. Reflecting on the results generally across the portfolio, we make the following observations:

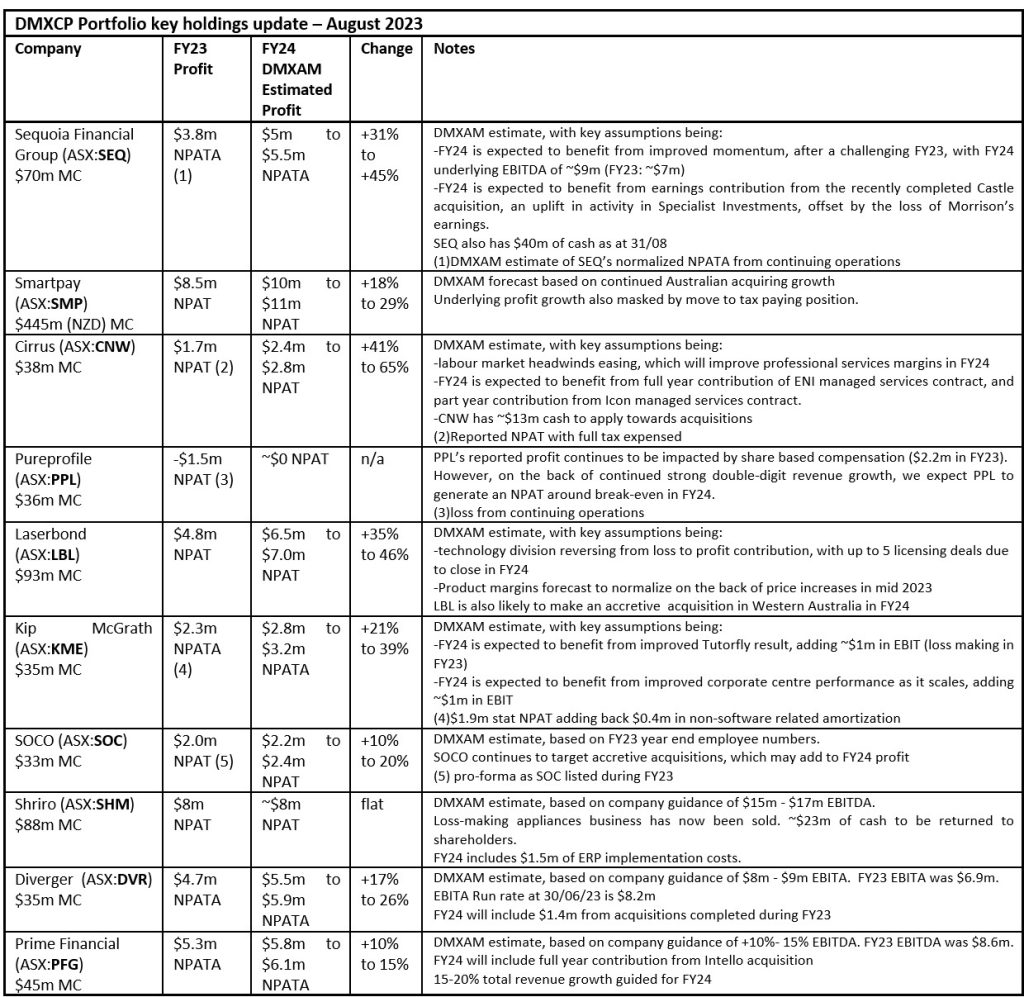

- Across our larger positions, we now have improved visibility on earnings growth during FY24. After reviewing the FY23 results, we detail how we are currently thinking about the growth profiles of our larger positions in the table below. As highlighted, we are expecting strong double-digit profit/EPS growth in FY24 across the majority of those names.

- On the back of the audited results for the year to 30 June 2023, we are enthused about the embedded value across the portfolio. We highlight in the bullet points below some of the value opportunities in some of the smaller nano-cap positions that we own.

- A number of positions that had disappointing results earlier in the financial year: Kip McGrath (ASX:KME), Datadot (ASX:DDT), AF Legal (ASX:AFL), Diverger (ASX:DVR) and Early Pay (ASX:EPY) all had significantly improved second halves, and have reported stronger momentum heading into FY24.

During the month we saw corporate interest in Energy One (ASX:EOL), with its share price up 30% as it granted exclusive due diligence to a US private equity firm for a possible takeover. Other positive contributions came from Laserbond (ASX:LBL)(+19%) and KME (+20%) which both reported strong second half results.

The largest detractor was Acadamies Australasia (ASX:AKG) which fell 30% after it reported a disappointing cash and profit result for the year. Other detractors included several of our small illiquid companies that fell on low volume.

Set out below are the reported FY23 profit results of our key holdings, and our expectations for FY24. We expect all these positions to be NPAT profitable in FY24, with 7 out of the 10 paying dividends.

Whilst forecasting is difficult at the best of times, we believe the drivers of, and assumptions supporting, the profit uplifts to be reasonable based on what we know at this point in time. The majority of these businesses exit FY23 with strong momentum, and we look forward to their progress during FY24. Strong NPAT/EPS growth will drive share price growth over time.

Among our other positions, we believe the full year numbers highlight the value across the portfolio. As noted below, we have built up reasonable holdings in each of the following illiquid companies over a long period of time. These sizes of positions are not easily replicated, so we would expect to benefit from the combination of low liquidity and value on offer here.

- Advanced Braking (ASX:ABV) – ABV reported a well flagged NPAT of $1.5m. ABV had a market cap of $14m at the end of August, with $2m cash. We expect strong revenue growth (>20%) and earnings growth to continue into FY24 as it offers a compelling ESG solution to its customers. We are a top 10 shareholder in ABV.

- AF Legal (ASX:AFL) – AFL reported an encouraging second half turnaround, following the board and management restructure during late 2022. H2 profit before tax was $622k H2, compared to a loss of $463k in H1, a >$1m turnaround. H2 revenue growth was >20% on the prior year. We would expect this encouraging momentum to continue into FY24. AFL has a market cap of $15m and net cash of ~$2m. We are a top 10 shareholder in AFL.

- Corum (ASX:COO) – COO reported a cash position of $12.8m, and expects to receive a further $7m from the sale of its non-core software business, providing a pro-forma cash position of ~$20m (although it awaits an appeal against its legal win over Fred IT earlier this year). COO had a market cap of $24m at the end of August, ascribing little value to its high quality, profitable, growing market dominant PharmX business. We are a top 20 shareholder in COO.

- Kinatico (ASX:KYP) – KYP reported its maiden (albeit modest) NPAT for the year, with EBITDA increasing 133% to $2.6m. With its second half NPAT of >$1m being a $2m+ turnaround from its first half NPAT loss of $1m, it is another position with strong momentum heading into FY24. KYP has a $40m market cap and ~$10m cash.

- Knosys (ASX:KNO) – KNO grew its recurring revenue from license and support fees 16% to $9.6 million in FY23. It is seeing early signs of improved market demand after many months of delayed decision-making from customers. At the end of August its market cap was $8m with ~$4m cash at the end of July, with its ARR approaching $10m and a very low enterprise value. We are a top 10 shareholder in KNO.

- Field Solutions (ASX:FSG) – FSG delivered an EBITDA result within guidance of $5m, and is forecasting for growth in EBITDA to between $5.5m and $7m in FY24. FSG has also guided to receive between $18m and $22m in government grants during FY24, which will increase its net tangible assets (regional tower infrastructure) to $45m. FSG’s market cap at the end of August was $30m. We are a top 20 shareholder in FSG.

- Yellow Brick Road (ASX:YBR) – YBR recorded an improved cash profit ($840K EBITDA) result in the second half, and continues to trade at a >50% discount to its NTA of 13c. YBR finished the month with a market cap of $20m, has $8m cash and a valuable (intangible) network of 1,200+ brokers and a $63bn customer loan book. We are a top 10 shareholder in YBR.

We think some of the pricing we are seeing here is reminiscent of GFC times – with the market having essentially given up on many illiquid, small companies. With buyers showing little interest, in many cases they are priced for failure, irrespective of the value on offer. However, all the companies we noted above have strong cash/asset positions and offer what we consider to be very interesting value supported by either their balance sheet or earnings profile. We continue to take advantage of the opportunity created by this market dis-interest, by selectively adding to positions.

As further evidence of this extreme pricing we are seeing at the smaller end of the market, we participated in the capital raise of Careteq (ASX:CTQ), which was priced at an EV of less than $2m. The raising price of 2.5c compared to its 20c IPO price in 2022. We will discuss our thesis for CTQ in a future update.

In summary, we finish the August reporting season enthused, and confident about the prospects and multi-bagger potential for many constituents of our portfolio of under-the-radar companies. We have attempted to illustrate some of these interesting set-ups above to give a sense of the opportunities that we are seeing.

We thank all our investors for your support and look forward to updating you again next month.

Subscribe to our monthly report

Each month we provide a commentary on news across our portfolio and drill down on specific companies of interest.

We’re proud to share our insights with a range of subscribers including current investors, prospective investors, private investors, and industry friends.