An investment company managed by

DMX Asset Management Limited

ACN 169 381 908 AFSL 459 120

13/111 Elizabeth Street, Sydney, NSW 2000

DMXCP directors

Roger Collison, Dean Morel, Steven McCarthy

Opening NAV (31 Aug 2025)

$2.8447

Closing NAV (30 Sep 2025)

$2.9943

Fund size (gross assets)

$34m

% cash held - month end

5%

1-month return

5.3%

1-year return

22.0%

3-year return (pa.)

14.9%

Since inception (10 years 3 month ) (pa.)

16.1%

Since inception (10 years 3 month )

383.2%

Dear Shareholder,

DMXCP’s NAV increased 5.3% (after all accrued fees and expenses) for September 2025. The NAV as at 30 September 2025 was $2.9943, compared to $2.8447 as at 30 August 2025. During September the All Ordinaries Accumulation Index fell 0.5%, while the Small Ordinaries increased 2.8%, and the Emerging Companies Index was very strong, up 12.8%.

During the month we saw EDU Australia (ASX:EDU) continue its re-rate – up 21%, Clover (ASX:CLV) rose 30% after a strong full year report, while Senetas (ASX:SEN), which we discuss below, was up 35%. With a strong broader market there were limited portfolio detractors – the most material being Findi (ASX:FND) which fell 10% as the market waits on evidence of earnings growth and acquisition integration ahead of its proposed 2026 Indian IPO.

September developments

Following a busy August reporting period, September was relatively quiet for portfolio newsflow. With bullish global markets, many stocks both in and outside of our portfolio rose due to buoyant investor sentiment and FOMO, rather than being driven by newsflow and/or fundamentals. Therefore, it was pleasing to see some developments that continue to highlight the genuine value on offer amongst our portfolio.

• We discussed last month how Verbrec (ASX:VBC), after many years of carrying significant debt, following a strong FY25, ended the year in a net cash position. During the month, VBC’s balance sheet was further improved when it announced the sale of its training business for $11.5m (upfront cash). The sale, once completed, will take VBC’s net cash to approximately $13.8m – representing more than 40% of its current market cap. Importantly, the sale enables management to focus on its core offerings: engineering services, asset management and operations & maintenance, and to potentially deploy some of its surplus cash into complementary acquisitions. With work in hand up 10% compared to six months ago, VBC is well positioned to grow, driven by strong tailwinds in its key sectors of renewable energy and defence. At month end, VBC had an implied EV of $16m, and ex the sale of its training business, is expected to generate ~$8m EBITDA and more than $4m NPAT – in our view, a very attractively valued business forecast to show encouraging growth in FY26, supported by a very strong net cash position.

• Another position that we think is becoming increasingly interesting from a value perspective is Senetas (ASX:SEN) which provides cyber security and network encryption solutions. During the month, SEN confirmed a capital return and provided further details around the ~$30m consideration it is expected to receive from the sale of its non-core investment in its partly owned Votiro subsidiary. For many years Votiro has been losing money and required ongoing capital raisings to fund its operations and growth. As SEN has had to consolidate the results of Votiro, it represented a major earnings drag on SEN’s group profits. With Votiro sold, SEN is now transformed from an unprofitable, cashflow negative company with a messy corporate structure, into a profitable, focussed investment with significant surplus cash/assets. After many years of being capital hungry, SEN is now returning capital to shareholders. Management noted that “With the Votiro transaction now largely behind us, SEN enters FY26 with a simplified business structure, increased focus on our core business, our largest ever sales pipeline, and significant growth opportunities”. With SEN’s reported net tangible assets of ~$42m approximating its market cap, the thesis here is simple: after accounting for SEN’s cash, investments and receivables, we are paying almost nothing for SEN’s profitable, globally leading, high-IP, cyber security business.

As mentioned above, where much of the market is trading at elevated valuation levels, we believe our portfolio which is very much weighted towards mis-priced and undervalued names such as VBC and SEN, provides plenty of opportunity for valuation uplifts, even if the broader market was to soften from here.

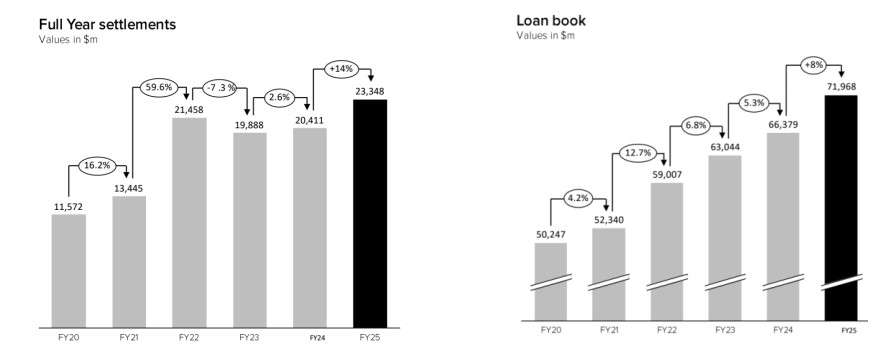

Unlisted positions

It has been some time since we have discussed our unlisted positions. With not a lot of news from our listed positions this month, this is a good time to provide an update. Our largest unlisted position (~4% portfolio weighting) is in Yellow Brick Road Holdings, which delisted from the ASX in 2023. Since then, YBR has focussed on taking costs out of its business, whilst pursuing various growth initiatives. The progress here since delisting has been pleasing, with key operating metrics (settlement value and loan book) each increasing to end FY25 at record levels.

This strong operating performance for YBR during FY25, delivered record financial results, including:

• Revenue grew by 9.1% to $249m (2024: $228m), driven by a 14.4% increase in settlements of $23b;

• Normalised cash EBITDA of $7.7m (an increase of $5.9m from FY24) reflecting increased business performance and cost efficiency gains resulting from YBR’s 2024 operational restructure;

• Profit before tax of $3.1m;

• Net cash of $11m; and

• Increase in NTA to 14c (from 13c)

We continue to value our YBR holding at ~NTA (~14c) – so we are ascribing little value to YBR’s intangible assets. With a very strong balance sheet, strong cash generation, positive industry dynamics (75% of all loans are settled via brokers) and encouraging tailwinds (lower interest rates will stimulate more demand/settlements), we are very comfortable with our position here, and the potential for YBR to contribute to significant portfolio value add in the years ahead.

Our other smaller unlisted exposure (~1% weighting), Tambla, an enterprise HR software and IT services company that delisted from the ASX in 2020. Over the last couple of years, Tambla has been investigating various liquidity opportunities for shareholders. To date, Tambla has sold its IT services business and some of its non-core software. These divestment activities have enabled 35 cents per share of shareholder distributions to be made (versus the 18c it last traded at on the ASX). Tambla continues to own its core workforce management software (now rebranded as Oahi) which it sells to enterprise and government organisations that have large, shift-based workforces. It has a current recurring revenue base of ~$3.3m, and is targeting breakeven this year, and $10m ARR over the next 3 years. While the value outcome here is unlikely to meet the more bullish expectations we had 12 – 18 months ago, we are pleased to have received some capital back here, and we continue to monitor the progress of Oahi to determine what the final valuation outcome will be.

ASX delistings

Both YBR and Tambla delisted from the ASX because, with their limited liquidity and continued mispricing, their directors (and subsequently shareholders) no longer considered it beneficial to stay listed. In both these cases, we supported the delisting – with the expectation that there would be a liquidity event available to shareholders within 3 – 5 years of delisting.

Amongst other illiquid and mis-priced stocks in our portfolio, we continue to see further delistings being considered, and we assess the merits of these on a case-by-case basis. Earlier this year, EDU proposed a delisting, offering a 16.5c buy-back option for those shareholders who did not want to continue in an unlisted vehicle. Our view here was that this was not the right time to de-list the company, that the buy-back offer substantially undervalued the business and that our firm preference was to have EDU remain listed. The delisting proposal with subsequently withdrawn following shareholder feedback. Earlier this month Shriro (ASX:SHM) advised the ASX that its Board had been considering a delisting but had decided against it. In this case, with the company no longer looking to acquire or use its script as currency (due to it being significantly undervalued) we were of the view that a delisting was a logical next step, and we were not opposed to it, although as noted, for the time being at least, the delisting is no longer being pursued by SHM.

While, to date, our experience with delisted stocks has been broadly positive, we are conscious of the illiquidity it brings to the portfolio. We are not averse to holding positions in unlisted entities, assuming they represent a compelling source of potential medium to long term upside, but given the illiquidity, we look to limit such exposures in aggregate to 10% or less of the portfolio.

————————-

We remain happy with the progress of the portfolio and enthused with the positions that we hold and the opportunities that we continue to review. We thank you for your continued support and look forward to updating you again next month.

Subscribe to our monthly report

Each month we provide a commentary on news across our portfolio and drill down on specific companies of interest.

We’re proud to share our insights with a range of subscribers including current investors, prospective investors, private investors, and industry friends.