An investment company managed by

DMX Asset Management Limited

ACN 169 381 908 AFSL 459 120

13/111 Elizabeth Street, Sydney, NSW 2000

DMXCP directors

Roger Collison, Dean Morel, Steven McCarthy

Opening NAV (30 Apr 2023)

$2.3163

Closing NAV (31 May 2023)

$2.2357

Fund size (gross assets)

$22m

% cash held - month end

3%

1-month return

-3.9%

1-year return

-9.3%

3-year return (pa.)

19.2%

Since inception (8 years) (pa.)

15.3%

Since inception (8 years )

218.1%

Dear Shareholder,

DMXCP’s NAV decreased 3.9% (after all accrued management fees and expenses) for May 2023. The NAV as at 31 May 2023 was $2.2357 compared to $2.3274 as at 31 April 2023.

Markets were negative during May – the All Ordinaries was down 3.0% while the Small Ordinaries declined 3.4%. The Emerging Companies Index had a particularly challenging month, declining 6.4% during May.

May Portfolio Developments

Against a backdrop of macro-economic concerns, tax loss selling, and apathy towards small and illiquid companies from retail and institutional investors, the portfolio again had a tough month. The news across the portfolio during the month was positive, with most of the declines reflecting poor sentiment rather than a reaction to any specific news.

The significant detractor during the month was Cryosite (ASX:CTE) which fell 35% on no news. Highlighting the volatility and lack of liquidity being experienced at the moment, CTE fell 27% on the last day of the month on volume of 10k shares ($6k). Outside of CTE, there were meaningful falls across a number of holdings including Energy One (ASX:EOL), Credit Clear (ASX:CCR), Earlypay (ASX:EPY), PeopleIn (ASX:PPE), Advanced Braking (ASX:ABV) and JoyceCorp (ASX:JYC) – all on no material news, but reflecting deteriorating confidence and sentiment. In the absence of news, and with little liquidity, poor sentiment combined with tax loss selling is driving prices lower. The companies that experienced positive share price movements during the month were on the back of positive news flow, including Pure Profile (ASX:PPL) +15% and AF Legal (ASX:AFL) +15%.

Notable updates during the month are discussed below.

EDU Australia (ASX:EDU) – AGM presentation and Quarterly Update

EDU held its AGM during May. During the month we also undertook a site visit of its Sydney campus and have spent time with management. EDU has two businesses: 1) ALG a vocational educational business offering courses in the likes of childcare, aged care and physiotherapy to international students, which, prior to COVID, had been consistently growing at 25%+. And 2) IKON a domestic focused higher education business offering fully accredited bachelor’s degrees and post graduate qualifications primarily to domestic students (now EDU’s largest business).

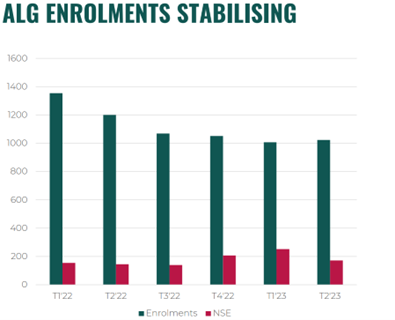

After pleasing progress prior to COVID, ALG student numbers have halved over the last three years given the limited new international students enrolling to replace graduating students. ALG’s revenue in FY22 also halved to ~$10m in FY22 from ~$20m in FY20 and became loss-making. However, in the semester just commenced (second term), for the first time in three years, net ALG student numbers have increased, and ALG is again growing its revenues.

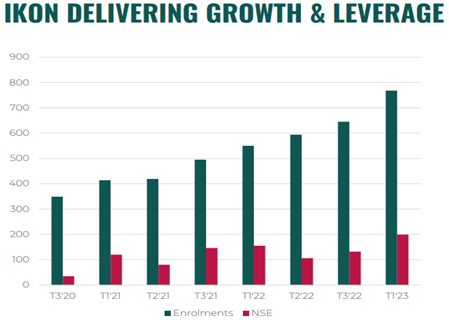

In contrast, EDU’s IKON domestic focussed business has performed, and continues to perform, very strongly, with increasing margins and revenue growth trending at +40% generating cash EBIT margins of 10%. New courses developed by EDU are generating this growth – as an example IKON developed and commenced offering a Bachelor’s degree in Early Childhood Education two years ago with an initial intake of 6 students. This has grown now to 250+ students, paying $65,000+ for a three-year course – an attractive price point relative to a $100,000+ degree from a university, and generating strong multi-year cash flows for EDU.

|

|

At a group level, the cash flows, profit and revenue growth of IKON have been offset by the challenges faced by ALG, although, as noted, ALG has now stabilised. Attending the AGM, the tone was upbeat:

- The group delivered a cashflow positive March quarter;

- After three years of declining student numbers, ALG is now growing its enrolment numbers again, with significant upside and operating leverage as classroom utilisation is still <50%;

- Student numbers and the profit of IKON continue to grow very rapidly (+46% revenue growth in 1Q23); and

- Average study time for a student across EDU courses is now over 2 years, with a number of new courses, including Masters’ degrees, in development to further extend the average student duration.

With the worst of trading conditions now behind it, EDU is positioned to deliver operating leverage, strong revenue growth and to continue to build out an attractive, high margin education business with numerous avenues to grow. Unlike English language focussed businesses (such as ASX:NXD) which offer commoditised, lower margin, short duration (less than 26 weeks) English courses, EDU provides a unique ASX exposure to high quality, highly regulated, higher education business with multi-year courses (providing a significantly larger lifetime value student spend) focussed on courses where there is a high demand for jobs. Assuming EDU completes its proposed nursing acquisition, it will qualify students towards four of the top ten occupations identified by the government as having critical skills shortages: early childhood teachers, childcare workers, aged and disability carers and registered nurses. The current immigration settings and demand for the jobs that EDU’s qualifications support, provide strong tailwinds for EDU from here, and a return to growing profits, and the 20-25% organic revenue growth the business was delivering pre COVID.

Field Solution Holdings (ASX:FSG) – Third quarter market update

FSG is constructing Australia’s largest rural and regional telecommunications infrastructure network, while its operating business provides a suite of managed ICT, connectivity and security services, to enterprises and governments in regional Australia.

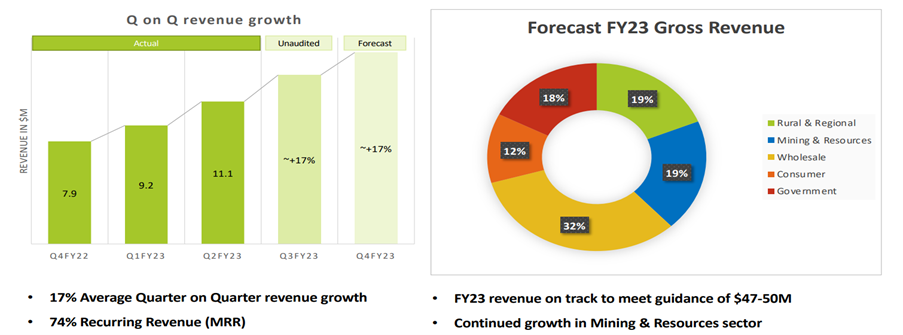

FSG’s core operating business continues to grow very strongly, recording organic revenue growth of 17% per quarter this year, as its offerings gain traction with mining companies, agri-businesses and regional government agencies/councils that are attracted to the improved digital connectivity services. As presented below, revenue from FSG’s core services should approach $50m this year, generating EBITDA of $10m+, with 74% of the revenue recurring in nature. Whilst this current growth rate is not sustainable, the opportunity here and pipeline and demand remain significant, with FY24 revenues of ~$70m expected.

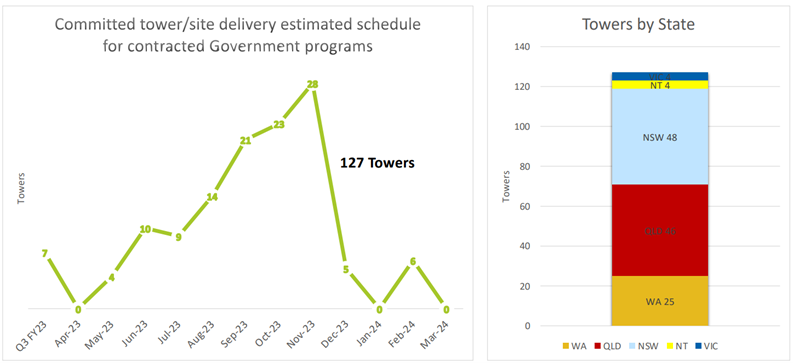

While the core business, which generates the real margin and growth, is performing well, the story is complicated as FSG is in the middle of building out its infrastructure network which requires capital to complete its government contracted tower roll-out and is running at a loss during its construction phase. However, by the completion of the roll-out (expected by March 2024 as shown below), FSG will have received a further $25m in government funding to cover the construction costs, and will own Australia’s largest rural and regional telecommunications infrastructure including Australia’s fourth mobile network. After raising $20m at 16.5c 18 months ago, the FSG share price traded around 5c during the month, with the market uncertain as to how FSG will bridge the funding of its construction costs, prior to the $25m cash being received from the government upon completion of the construction. The company is confident that no new equity will be required to fund the completion of the construction.

While we acknowledge that there is some near-term funding uncertainty, we think taking a 12-month view, FSG’s current EV of $40m undervalues the opportunity here:

- a fast-growing core business providing mission critical digital and connectivity services to key regional and rural enterprises, on track for $50m of revenue (at 20% EBITDA margins) of which 74% is recurring, and

- the owner of a significant tangible asset base comprising the largest rural/regional telecommunication and tower network in Australia (for the most part funded by state/federal governments) that will provide an urban standard of digital connectivity to areas of Australia that have been neglected by the major carriers. The value of this completed network should far exceed FSG’s current enterprise value.

Pure Profile (ASX:PPL) – Third quarter results

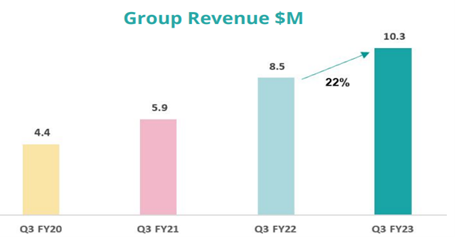

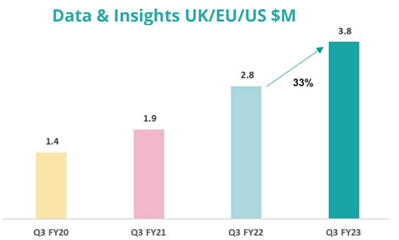

PPL announced its third-quarter results in early May. PPL’s core business experienced 22% revenue growth, thanks to the investment in the sales team made over the last year. Pleasingly, PPL’s UK operations continue to grow very strongly (+33%) in a tough macro environment, validating Management’s investment in recent years in building out this geography. Revenue here has grown organically 150%+ over the last three years, providing some confidence in PPL’s global growth strategy as it looks to capitalise on opportunities in America and Southeast Asia

|

|

PPL’s media business, Pure Amplify, has faced challenges in the current economic climate. Following the closure of its UK office last year, the Australian business will also be gradually shut down in the coming months. Although it was a difficult decision, it appears to be a sensible one as it is a non-core division that was incurring losses. Now that the significant investment in the sales team is behind them and the unprofitable businesses closed, PPL is optimistic about achieving higher margins and profitability in FY24.

Towards the end of the month, Linda Jenkinson joined the board as Chair. Linda is known to us for her role as Chair at Medadvisor (ASX:MDR), where she has overseen a number of positive operational and governance improvements since her appointment. Importantly, under her leadership, MDR is now growing and approaching profitability. As Linda divides her time between the US and Australasia, she hopes to contribute to PPL’s ambitions in the American market. PPL’s board has been overdue some renewal and we believe this change of chair to be positive, and we look forward to PPL continuing its global growth under Linda’s stewardship.

In other portfolio news announced during May:

- AFL Legal (ASX:AFL) announced its return to profit in Q3 and expectations of further profitable growth;

- PeopleIn (ASX:PPE) reaffirmed its FY23 profit guidance and highlighted improvements in relation to its international recruitment business;

- Findi (ASX:FND) reported an NPAT for FY23 of $2.4m (up from a loss in FY23) and has guided for NPAT of $4.0m in FY24 (+64%);

- Smartpay (ASX:SMP) reported an NPAT for FY23 of $8.5m (up from $2.2m in FY23);

- Aeeris (ASX:AER) advised of progress with its Climatics climate reporting and risk analysis product, as well as a significant R&D refund, and

- Corum (ASX:COO) advised it is to receive in June 2023 a further $3m in costs and interest, following its recent successful litigation.

In summary, news and progress across the portfolio remains positive, with the portfolio companies, on the whole, growing strongly and profitably.

Portfolio comments

We are confident that the recent share price action across the portfolio is not reflective of the underlying fundamentals, which in our view, for the most part, remain positive. We own a portfolio of growing profitable businesses, with strong long term investment cases, and attractive valuations. As highlighted above, FSG, PPL, and EDU are all businesses with long growth runways with the ability to consistently grow revenues at 20%+. Last month, on the back of their respective updates, we highlighted in our April report the strong growth in AER, ABV, AVA Group (ASX:AVA) and Kinatico (ASX:KYP)’s SAAS business which are also growing revenues at 20%+, and the significant profitable, growth opportunities in front of those businesses.

When interest does return to these small companies, the combination of improved fundamentals, low liquidity and low valuations, should provide the opportunity for strong re-rates. It would be extremely challenging buying a position of any reasonable size in the likes of the companies mentioned above such as PPL, COO, KYP, EDU, FSG, AER and ABV.

We note that during the GFC, the Small Ordinaries fell to 1,482 in March 2009, before rising 93% to 2,858 in February 2011 – almost doubling in just under two years. Our experience from that period was that the type of companies that we own in our portfolio today (small, illiquid, low market caps) were among the best performers over that recovery period, highlighting that prices can move quickly when interest does return to this part of the market.

We thank all our investors for your support and look forward to updating you again next month.

Subscribe to our monthly report

Each month we provide a commentary on news across our portfolio and drill down on specific companies of interest.

We’re proud to share our insights with a range of subscribers including current investors, prospective investors, private investors, and industry friends.