An investment company managed by

DMX Asset Management Limited

ACN 169 381 908 AFSL 459 120

13/111 Elizabeth Street, Sydney, NSW 2000

DMXCP directors

Roger Collison, Dean Morel, Steven McCarthy

Opening NAV (29 Feb 2024)

$2.3883

Closing NAV (31 Mar 2024)

$2.4121

Fund size (gross assets)

$23m

% cash held - month end

4%

1-month return

1.0%

1-year return

8.7%

3-year return (pa.)

2.5%

Since inception (8 years 10 months) (pa.)

15.1%

Since inception (8 years 10 months)

255.5%

Dear Shareholder,

DMXCP’s NAV increased 1.0% (after all accrued management fees and expenses) for March 2024. The NAV as at 31 March 2024 was $2.4121, compared to $2.3698 as at 29 February 2024.

Australian equity markets rose in March, with investor sentiment improving on the back of moderating inflation and in anticipation of interest rate cuts – the All Ordinaries was up 2.4% while the Small Ordinaries increased 4.2% and the Emerging Companies Index rose 5.8%.

For the third successive month, Findi (ASX:FND) did the heavy lifting for the portfolio, finishing the month up 29%. Detractors included a range of small, illiquid positions falling on low volume and no news, as well as Careteq (ASX:CTQ), which fell 28% on some mixed news as discussed below. As mentioned last month, a number of illiquid small companies continue to trade around their multi-year lows and haven’t yet benefitted from a sentiment kick up seen elsewhere in the market. We continue to add to those positions where we think the risk reward looks attractive from these beaten-up levels.

Findi (ASX:FND)

FND has experienced a significant re-rate in recent months, with its share price moving from ~50c in October last year, to trade above $3 during March. When we first invested in FND in early 2022 via underwriting a capital raise, it had a market cap of less than $5m, and was seeking capital to fund the buyout of the 75% of its Indian ATM and fintech business that it didn’t currently own. At the time, the stock was very much under the radar and misunderstood, and, as a result, in our view, was fundamentally mispriced relative to its potential future earnings profile, offering significant upside.

In our December blog article we discussed the FND opportunity and our $3 valuation target: Findi – A potential multi-bagger – DMXAM. During March, FND’s market cap reached $150m, while liquidity has gone from non-existent two years ago, to $1m+ of stock trading daily over recent weeks. We have been selling into this increased liquidity over recent weeks as our price targets were met.

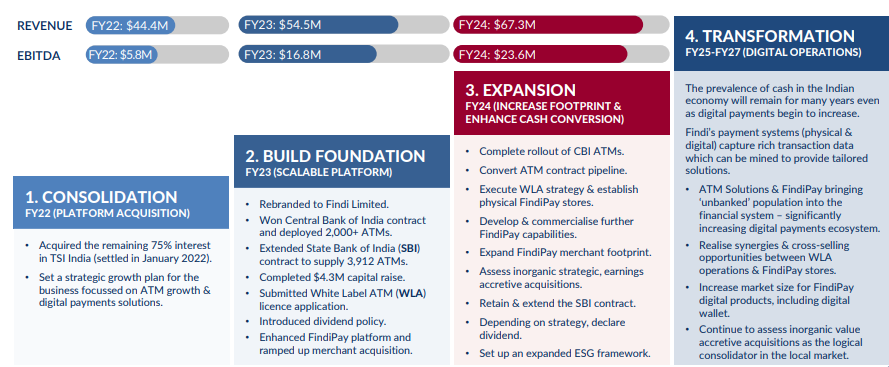

While our thinking around FND’s expectations and valuation hasn’t changed much from how we viewed the FND opportunity two years ago, the passing of time has allowed new investors to get more confident with management and execution, which has been strong over the past two years. While various operational and regulatory risks remain, as highlighted in the table below, FND’s ~20% revenue growth, and operating leverage, over the past two years has led to strong growth in EBITDA from ~$6m to ~$24m. FND’s balance sheet has also strengthened and we expect FND to finish its financial year with ~$30m net cash, following the recent option conversion.

We believe FND to be a good example of what we are trying to achieve and highlights the opportunities available to us in supporting mispriced, under the radar companies with attractive fundamentals, that are currently being ignored by the market because they are too small, illiquid and out of favour to generate market interest.

The last couple of years has been a difficult environment for this strategy. Certainly, execution issues amongst some of our portfolio companies hasn’t helped, but in this risk-off environment a significant challenge has been just the lack of investor interest and liquidity to generate new buying to clear the overhang of sellers in order to drive multiple re-rates and sentiment changes amongst small stocks.

Across the portfolio, we own various other companies that share similar characteristics to FND when it was very much under the radar: profitable, very low market cap, tight illiquid share register, unloved, ignored and in-efficiently priced by the market, but with the ability to capture market interest to drive a strong re-rate at some point. In recent updates we have talked about a number of portfolio companies that have been beaten down by the market to very low EVs that now offer substantial upside on the back of improving execution and sentiment from low bases. With more supportive market conditions, we are hopeful of more of these types of opportunities playing out.

Other portfolio news

- In last month’s Investor Update, we noted that we were finally starting to see some light at the end of the tunnel for EDU Australia (ASX:EDU) with much improved business momentum on the back of strong revenue growth and operating leverage emerging during 2023. During March, we saw further evidence of this improved momentum, with EDU announcing that new student enrolment numbers in its first intake of the year for its key Ikon business up 125% on the 2023 intake. Ikon sources 95% of its students (domestic and international) from within Australia, so isn’t impacted by visa issues. These encouraging numbers support continued very strong revenue growth and improved profitability and cashflows for EDU during 2024.

- It was an eventful month for Careteq (ASX:CTQ). Negatively, CTQ received a position paper from the ATO advising that the ATO was of the view that CTQ had not provided evidence of adequate substantiation for expenditure incurred for its R&D activities and therefore was not entitled to refundable tax offsets of ~$1.3m. CTQ disputes this. The ATO has invited CTQ to make further technical and factual submissions in relation to the position paper, however this will take time to play out unfortunately. More positively, was the appointment of an experienced ASX executive as CEO to take full advantage of the growth opportunities they are seeing, with CTQ re-affirming a positive outlook: “the Company is well positioned to deliver accelerated growth and reaching its stated aim of being profitable and cash flow positive heading into FY25”. CTQ’s current EV is ~$1m.

- During the month we participated in the rights issue of AFL Legal (ASX:AFL). The rights issue priced AFL at a $15m market cap, with pro-forma NPAT of ~$1.5m. With its current $25m revenue base, and a national platform to grow its family law and contested wills business, the opportunity is here to improve AFL’s scale and operating margins by leveraging a relatively fixed overhead cost base. Margin expansion from the ~7% NPAT margins implied currently to 10% (a level still well below other ASX listed legal firms) would see $30m of fee revenue generating $3m+ of NPAT. So we see plenty of upside from here but strong execution and integration is required.

Portfolio musings

After a challenging couple of years in our space, we do feel a sense of improved momentum and optimism:

- There are clear green shoots of interest returning to some very small names, with the market happy to re-rate stocks from very low bases; i.e. FND as discussed above;

- We continue to see takeover activity across the portfolio – Ansarada (ASX:AND) last month, and Diverger (ASX:DVR) and Cirrus (ASX:CNW) in the later half of 2023, which is validation that private equity and industry players see value and opportunity in companies that we hold;

- Many of our mid-sized portfolio positions (2% – 4%) that are prospective, profitable sub $100m cap companies such as Pure Profile (ASX:PPL), Laserbond (ASX:LBL), Kip McGrath (ASX: KME), AF Legal (ASX:AFL), Prime Financial (ASX:PFG) and Count (ASX:CUP) are all trading close to their 52 week or multi-year lows, and haven’t benefited from any positive market sentiment. Many of these positions have been a significant drag on the portfolio, but now offer attractive upside from their marked down levels; and

- We are also seeing progress behind the scenes in relation to holdings that we are looking to be more active in, which could unlock value and drive further upside.

Reflecting the above, and some of this improved momentum, the portfolio is up 15% financial year to date from its June 2023 low. Significant contributions from FND, CNW and AND have been offset by continued weakness amongst some of the mid-sized positions mentioned above, and a lack of market interest in nano-cap stocks. We continue to see considerable near term and long-term value upside across the portfolio.

We thank all our investors for their support and for the confidence you have shown in us and our strategy.

Subscribe to our monthly report

Each month we provide a commentary on news across our portfolio and drill down on specific companies of interest.

We’re proud to share our insights with a range of subscribers including current investors, prospective investors, private investors, and industry friends.