An investment company managed by

DMX Asset Management Limited

ACN 169 381 908 AFSL 459 120

13/111 Elizabeth Street, Sydney, NSW 2000

DMXCP directors

Roger Collison, Dean Morel, Steven McCarthy

Opening NAV (30 June 2023)

$2.1841

Closing NAV (31 July 2023)

$2.3710

Fund size (gross assets)

$23m

% cash held - month end

3%

1-month return

8.5%

1-year return

-1.5%

3-year return (pa.)

14.8%

Since inception (8 years 4 months) (pa.)

15.8%

Since inception (8 years 4 months)

235.7%

Dear Shareholder,

DMXCP’s NAV increased 8.5% (after all accrued management fees and expenses) for July 2023. The NAV as at 31 July 2023 was $2.3710 compared to $2.1841 as at 30 June 2023.

Markets were strong during July – the All Ordinaries was up 2.99% while the Small Ordinaries rose 3.47% and the Emerging Companies Index increased 3.98%.

July Portfolio Developments

After a challenging period leading up to the end of the FY23 financial year, conditions have improved in July, with the conclusion of year-end tax loss selling and some positive news-flow resulting in improved interest being observed among many small companies.

On the back of solid earnings confirmations, Energy One (ASX:EOL) was up 43%, Cirrus Networks (ASX:CNW) increased 22% and Pure Profile (ASX:PPL) recovered 23%. With improved sentiment, the prices of some smaller portfolio positions rebounded strongly – Datadot (ASX:DDT), Ansarada (ASX:AND) and Raiz (ASX:RZI) each increased ~50%.

The only material detractor was Field Solutions Group (ASX:FSG) which declined 15%.

As we head into full-year reporting for FY23, July saw increased news flow, which for the most part was positive. The weakening economy is providing challenges with a softer fourth quarter reported by PPL, while Smartpay (ASX:SMP) noted an increase in small business customer churn. However, the majority of portfolio holdings continue to report double digit revenue growth and deliver on milestones.

We discuss below four holdings that updated the market during the month, demonstrating improvement in their fundamentals and providing us with confidence that our theses are on track. While the positions noted aren’t in our top 10, they are 1.5% – 3% exposures that we think have meaningful upside from their current low market caps. We discuss below why we think these positions remain misunderstood by the market and offer real re-rate potential.

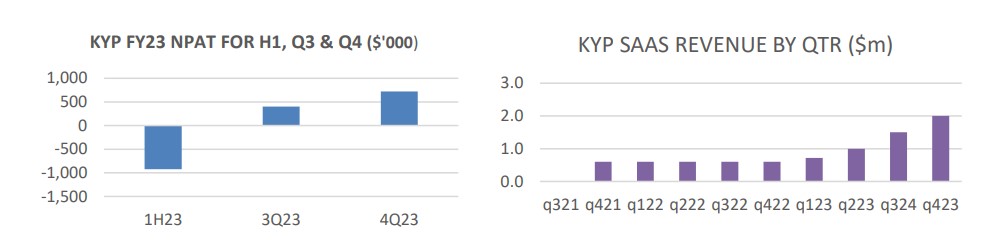

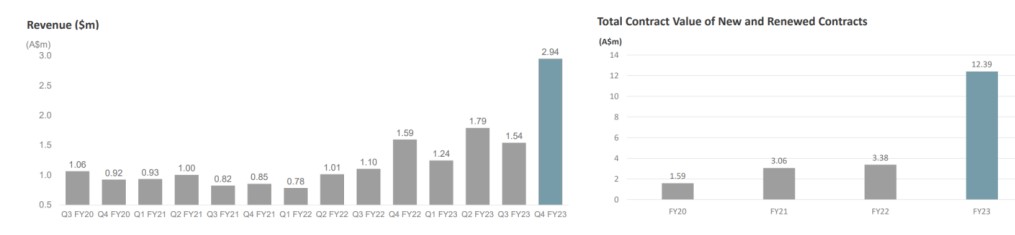

Kinatico Limited (ASX:KYP) – maiden NPAT for year

RegTech company, KYP, announced it had achieved its maiden NPAT in FY23, a significant milestone having first listed in 2015. While this appears to be a modest annual profit of “greater than $200,000”, more interesting is the significant improvement in profit trajectory through the year, with the fourth quarter delivering an NPAT of >$700k. This implies an annual rate of profit closer to $2.9m, and as mentioned last month, we would expect KYP to deliver a break-out profit result in FY24. This profit uplift has been driven by a combination of successful operational improvements and strategy execution. In the first half, KYP was able to finalise the implementation of some significant automation in its backend systems, reducing headcount by 25% and delivering a material increase in margin.

The other driver of the profit improvement has been the growth in higher margin, and more consistent, SAAS revenue, which increased over 100% during the year. New and existing customers have been taking up KYP’s SAAS offering which helps them monitor their employee’s compliance with a variety of safety, security, training, educational and regulatory obligations. This enables KYP to capture revenue through the life of the employee, rather than just at the recruitment stage as was previously the case. Importantly, the revenue is stickier as the software becomes embedded into business processes. With NPAT profitability and the growth in SAAS revenue, the quality of the KYP business is beginning to be noticed by the market with the share price recovering off its April lows. However, we think the strength of its turnaround and change in strategy is underappreciated, with the business for the most part still perceived as a ‘CV checker’. With $10m cash, and a strong profit growth profile with NPAT potentially approaching $3m this year, we think KYP is transitioning into a much more valuable business.

Advanced Braking Technology Ltd (ASX:ABV) – meaningful revenue growth and operating leverage

ABV designs, manufactures and distributes its innovative failsafe braking solutions and for FY23 reported a 28% increase in revenue, a significant improvement in gross margin and a 129% increase in NPAT to $1.5m. This strong result has been driven by several key tailwinds: 1) an increasing focus by miners on ESG concerns (ABV’s brakes are sealed, therefore don’t produce emissions); 2) continued investment in underground mining (failsafe brakes are mandatory on vehicles that operate underground and ABV is one of two key suppliers of these brakes aftermarket) and 3) a continued focus by its customers on safety, particularly in emerging markets where there is significant catch up in safety standards required. We believe that these drivers will continue for some time and expect FY24 to be another year of very strong organic growth, with an NPAT of >$2m achievable. With plenty of historical baggage, and a perception in the market that ABV is a low-quality mining services provider, we think that as the market becomes more comfortable with its growth profile and the quality of the IP and opportunity here, there is potential for a material re-rate.

Meanwhile, ABV also continues to progress the development of a new heavy vehicle brake, which has the potential to significantly expand its addressable market, selling its $100k – $200k braking systems into much larger fleets of underground haulage trucks. Again, while this is at an early stage, none of this ‘potential’ is reflected in ABV’s current $15m market cap.

Corum Group (ASX:COO) – sale of under-performing software business

COO has agreed to sell its pharmacy software business to Jonas Group, a subsidiary of Constellation Software Inc (TSX:TSU) for $6.25m. We previously highlighted the possible sale of Corum’s pharmacy software business as being an important valuation catalyst. This sale, along with a resolution of some ongoing litigation, will leave COO with a cash-rich balance sheet (>$17m). The Corum board can now explore capital management initiatives, and focus on driving growth in its remaining higher quality operating business, PharmX, a B2B ordering gateway between pharmacies and suppliers.

The pharmacy software business is intensely competitive with Corum unable to raise prices, while having to add government mandated functionality to the product. With limited pricing power, a static market, and further capital investment required, we think the decision to sell this (less interesting) part of Corum is sensible.

In addition to the cash received, there are other benefits to the sale including:

- Corum’s software business required significant ongoing capital investment– we would expect Corum’s reported free cashflows to improve following the sale.

- As Corum is no longer competing with other pharmacy software vendors, PharmX can be seen as an independent service provider.

- Selling to a new entrant keeps the pharmacy software vendors suitably fragmented. Again, this keeps the PharmX business in a strong position as there will be less incentive for POS vendors to develop their own version of PharmX.

- It will allow management to focus on Corum’s PharmX and emerging PharmXchange businesses.

We expect Corum to provide more clarity on its total cash balance and the underlying profitability of the PharmX business when it reports in August, which should highlight the significantly improved fundamentals here.

8common (ASX:8CO) – free cash positive quarter with contracted revenue building

Expense management company 8CO reported a very strong final quarter (revenue up 85%) with a 65% increase in revenue during FY23 and a 24% increase in SaaS Revenue. After a number of quarters of negative free cash as its federal government contract ramped up and capital expenditure remained high, 8CO was pleasingly able to deliver positive free cash this quarter. Importantly contracted revenue has increased three-fold as 8CO onboards new government clients onto its platform. As at 30 June 2023, only 32k of the potential 110k to 170k of government users have been onboarded, providing 8CO with a further two years of embedded growth in both implementation fees and recurring revenue as it rolls out its platform to additional government departments.

The market will be looking to see that this quarters’ result is repeatable, but with growth set to continue, we expect 8CO to generate free cash flow quarters from here, which should produce a meaningful free cash result for FY24. We think that the low point in 8CO’s cash position was 31 March 2023, and increasing cash from here should dispel the view that 8CO is cum-raise. We also note that 8CO has a listed investment of ~$1m that it is able to liquidate. Our view is in fact 8CO is more likely to look at capital management initiatives from here, than it is to raise cash.

While sentiment towards small companies remains poor, we may be seeing the early signs of some improvement. Improved sentiment, more investors ‘doing work’ on these companies to better understand them, and continued improvements in fundamentals should drive re-rates of these companies over time. With a number of our positions still trading at multi-year lows and well below their intrinsic values, we look forward to this playing out.

We thank all our investors for your support and look forward to updating you again next month.

Subscribe to our monthly report

Each month we provide a commentary on news across our portfolio and drill down on specific companies of interest.

We’re proud to share our insights with a range of subscribers including current investors, prospective investors, private investors, and industry friends.