A wholesale unit trust managed by

DMX Asset Management Limited

AFSL 459 120

13/111 Elizabeth Street, Sydney, NSW 2000

Trustee & Administrator

Fundhost Limited AFSL 233 045

Unit price (mid) based on NAV (30 Apr 2023)

$1.0119

Unit price (mid) based on NAV (31 May 2023)

$0.9707

Number of Stocks

42

% cash held - month end

5%

1-month return

-4.1%

12-month return

-5.4%

Since inception (1 March 2021) pa

0.7%

Fund size (gross assets)

$10m

Dear Investor,

DMXASF’s NAV declined 4.1% for the month of May, broadly in line with the declining market. The ASX 200 Total Return Index declined 3.3%, but the ASX Emerging Companies Index was down 6.4%. Smaller companies in particular continue to face selling pressure, and with just a month until the end of the financial year, tax loss selling we believe is accentuating this.

Commentary

May’s decline extends what’s turned out to be a ~18-month period of consolidation both for the smaller companies sector generally, and our portfolios specifically. As discussed in previous reports, the magnitude of the contraction in value to our portfolios has been less than that of the broader smaller-companies sector. But this hasn’t really mitigated the pain, with a number of our holdings not working out as anticipated due to adverse developments outside of our control, together with a few own goals.

While maintaining a diverse portfolio exposure helps reduce the impact of any individual material movement, the 35% decline to Cryosite (mostly on the last day of the month) on a trivial number of shares traded is single-handedly responsible for almost half our decline.

Other meaningful detractors included Earlypay which declined 24% to hand back its prior partial recovery. With limited liquidity at present for smaller companies, Energy One declined 19% on no news and small volumes. Frontier Digital Ventures again cost us with its shares falling 26% over the month. We’ve heard the term “hate selling” to describe the shares recently, with investors very much anchored on the recent capital raise conducted at a distressed valuation. As previously noted, while the optics of the raise weren’t good, the dilution was reasonable considering the capital raised and strengthening of its balance sheet. This is now likely being accentuated by tax loss selling as we head into June. We’ve added modestly to our Frontier holding to maintain its relevance in the portfolio in the face of its decline in recent times. Finally of note, NZX-listed General Capital declined 21%, handing back some of its prior gains. Having trimmed at higher prices, we’ve been well-positioned to opportunistically add to our holding at these marked-down levels. General Capital is discussed further, below.

Offsetting some of these significant declines have been continued strength in Smartpay which rose another 10% and has become our stand-out largest position (at an approximate 7% weighting). Despite its re-rate over the past year or so, SmartPay’s pricing remains reasonable in our estimation considering its historic execution, current business momentum, and its anticipated growth potential for the years ahead.

The DMX Capital Partners report contains updates on EDU Holdings and Pureprofile, each of which is commonly owned by DMXASF. As usual, this content is presented in an Appendix to this report.

General Capital: A Growing force in the NZ Non-Bank Finance Sector

General Capital is a non-bank deposit taker and lender that specialises in situational or bridging loans, with its loans having an average duration of around eight months. These loans cater to individuals, such as retirees, who want to downsize without rushing into selling their homes. The company charges higher interest rates, including approximately 2% establishment fees, reflecting a slightly higher risk profile as well as the borrowers’ inability to access cheaper funding from traditional banks. Additionally, General Capital has a small advisory business that assists companies in listing on the New Zealand Stock Exchange (NZX).

Much of General Capital’s loan book is effectively funded by retail deposits, alongside its own significant equity position, and the company enjoys a solid BB Credit Rating. The company’s strong capital position, positive investment grade rating, and broad depositor base gives it an advantage over competitors that often have less reliable funding sources.

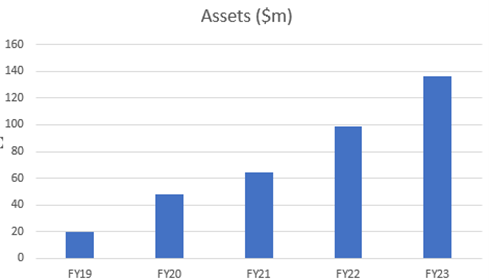

Loans for General Capital are primarily sourced through mortgage brokers who have been unsuccessful in securing loans from traditional banks who themselves are focused on lending to an increasingly narrow customer group (salaried individuals). Loans are individually approved on a case-by-case basis, with the CEO signing off all deals. The company’s assets have grown significantly from $16 million to $136 million since 2018, demonstrating its ability to attract investors and source loans through its broker network.

General Capital must disclose its capital position to its regulator quarterly. These disclosures highlight a conservative capital ratio of 21.8% and a loan profile showing that the bulk of loans are first ranking and have LVR’s of < 70%. Additionally, their deposit and lending cashflow profiles are well matched to ensure adequate liquidity.

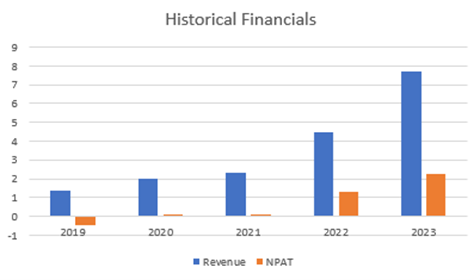

In terms of financials, General Capital reported net revenues of $7.7m (up 71%) and net profit after tax of $2.3 million (up 68%) for financial year (31st March) 2023 (up 68%).

Inside ownership is high with Chair Rewi Bugo holding 35% and MD Brent King holding 5%. More recently, Auckland-based private equity firm Ascentro has joined the register with a 24% stake following a significant private placement, and has installed two new directors. The non-bank finance industry in NZ is highly fragmented, and the introduction of a hands-on private equity operator of Ascentro’s calibre, we believe, positions General Capital well as a vehicle to drive some consolidation in the sector. The cash injection from its significant capital raising provides valuable equity that will help support the company’s next big leg of growth.

We find the situational or bridging loans financing space attractive with high security and favourable economics, and believe General Capital as well placed to continue to grow and achieve operating leverage in the periods ahead. We initially invested in General Capital in late 2022, and have taken advantage of a little liquidity and an attractive price point to add to our holding recently. Where we have been recently buying, the shares have been trading at just a 10% premium to tangible equity value, and just 10 times last year earnings (perhaps 8-9 times forward earnings), despite holding surplus equity capital of 20%+ of its market capitalisation. As the company puts its freshly raised equity to work, together with reinvesting profits, we expect earnings can grow 50%+ over the next 2-3 years.

Summary

The declines to our NAV that we’ve experienced over the past 12-18 months are never pleasant to report. And while we’ve clearly absorbed some material declines across various individual portfolio holdings, the portfolio is virtually fully exposed to a diverse range of what we believe are quality businesses with good long-term prospects and trading at very attractive levels.

We’re very happy with our portfolio positioning and are enthused about the future as we continue to methodologically and diligently execute on our time-tested investment process.

If you’d like to discuss the portfolio or the potential to invest or add to an existing investment, please contact Michael any time at michael.haddad@dmxam.com.au or 02 80697965.

Subscribe to our monthly report

Each month we provide a commentary on news across our portfolio and drill down on specific companies of interest.

We’re proud to share our insights with a range of subscribers including current investors, prospective investors, private investors, and industry friends.