A wholesale unit trust managed by

DMX Asset Management Limited

AFSL 459 120

13/111 Elizabeth Street, Sydney, NSW 2000

Trustee & Administrator

Fundhost Limited AFSL 233 045

Unit price (mid) based on NAV (31 May 2023)

$0.9707

Unit price (mid) based on NAV (30 June 2023)

$0.9750

Number of Stocks

40

% cash held - month end

3%

1-month return

0.4%

12-month return

5.7%

Since inception (1 March 2021) pa

0.9%

Fund size (gross assets)

$10m

Dear Investor,

DMXASF’s NAV increased 0.4% for June, in a mixed but generally strong market environment with the ASX 200

Total Return Index rising 1.8%, and the ASX Emerging Companies Index recovering 2.4% after a big decline in

May. June marks the end of tax selling season, with selling pressure on losers continuing through the month, but

clearly subsiding as we move into July.

Commentary

As is often the case, June was flat from an NAV perspective on a net basis, but we experienced some decent

sized moves in both directions at the individual stock level. Declines of 10-18% were recorded across names such

as Corum, Findi, Pureprofile, SOCO Corporation, and Yellow Brick Road, and all for no particular reason. On the

other side of the ledger, Cryosite recovered 13%, General Capital & Kip McGrath each rose 13-17% as they

reported positively, and Academies Australia & AF Legal rose 21-23%.

Notable updates during the month included:

DDH1

DDH1 received a merger proposal from fellow ASX-listed Perenti, with DDH1 shareholders offered $0.1238 cash

plus 0.7111 Perenti shares for each DDH1 share held. Substantial shareholder, Oaktree Capital (of Howard Marks

fame) appears to want an exit, having helped bring the company to the ASX in 2021. The pricing implied a 17.4%

premium at Perenti’s then share price, but a discount to where the company IPO’d in 2021, and a substantial

discount to our valuation.

Despite Oaktree’s enthusiasm for finding an exit here, we and other shareholders are less keen, as implied by

Perenti’s share price decline post-announcement. Alongside Oaktree as a substantial shareholder are key

founder-executives across the group, and we would have hoped a sale process would have been more

competitive. International peer, Major Drilling, by way of example trades at a significant premium to DDH1. The

value discrepancy may yet yield a higher competing offer, but an agreement between Perenti & Oaktree giving

the former an option over Oaktree’s 20% stake serves as something of a blocking stake. To us on the outside, it

seems a little odd, and we’ll need to wait and see how this plays out.

Kip McGrath

Kip McGrath has presented a year-end trading update for FY23, including revenue and net profit forecasts. The

projected revenue for the year is expected to range from $26.9 million to $27.3 million, showing a 10% increase

compared to last year. The net profit for FY23 is anticipated to be down slightly, within an estimated range of

$1.7m to $1.9m. These not great but not too bad results have been well-received by the market with Kip

McGrath’s shares ticking up both by June 30th and further into July.

The commentary also highlighted the company’s continued substantial investments in global growth

opportunities, particularly in the US Tutorfly business, which we understand is investing into its salesforce as the

company sells into US school districts. While group-wide profitability has declined, it is reassuring to note that

this drop is attributable to the expanding US investment, rather than a lack of demand for tutoring services in

its core Australian and UK operations.

Sequoia

As reported on in prior monthlies, Sequoia had reached agreement to sell an 80% stake in its Securities Clearing

business – Morrisons. Uncertainty surrounding deal completion has weighed on its shares with the purchaser,

New Quantum, needing to secure deal finance. The deal’s second key milestone has now been reached, with

over $25m of the $40m purchase price having been received (over $7m of which is non-refundable in the event

of the deal not ultimately completing). Either way, real value has been created with this transaction, and the

cash injection for Sequoia will facilitate increased shareholder distributions (including dividend and buyback), as

well as strengthening its balance sheet to reinvest strategically within its other verticals.

In addition to the above updates, the DMX Capital Partners report includes a brief summary of its Top 10

holdings, all of which are also owned by DMXASF and with considerable Top 10 overlap. The overview really

showcases the breadth of our opportunity set, and the prospectiveness of our portfolios. This content is

reproduced as an Appendix to this report.

Performance Commentary

After a strong initial performance run in 2021, we’ve handed back gains and struggled to get traction in terms

of the bottom line to investors. Some individual investments have been regrettable, while others have

performed very well. And the backdrop has been one of a particular challenging smaller company sector over

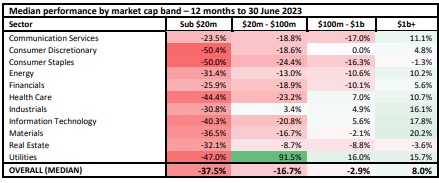

the past 18 months or so. The DMX Capital Partners report highlights the trouncing many smaller companies

have faced over the past year, as highlighted in the table reproduced below:

Again, as highlighted in the DMXCP report, market conditions and de-rating to so many companies have brought

us to a position where the overall prospectiveness of our portfolios – we believe – has never been greater. Some

meaningful declines in share prices for individual names have been absorbed by the broader portfolio in recent

times, with some of these now potentially spring-loaded to deliver handsomely into the future.

Thank you for your ongoing trust and support.

Subscribe to our monthly report

Each month we provide a commentary on news across our portfolio and drill down on specific companies of interest.

We’re proud to share our insights with a range of subscribers including current investors, prospective investors, private investors, and industry friends.