RPM owns a number of automotive businesses that have been acquired (often by debt) since its IPO in 2019. Today RPM has a substantial national footprint with 26 retail locations, 11 distribution centres and revenues of $130m+, selling wheel, tyre, accessories and apparel products to wholesale and retail customers. Tyre sales comprise 70% of RPM’s business, of which 80% is to commercial customers (trucks, commercial fleets and off-road/mining/earthmoving), with passenger cars comprising the remaining 20%.

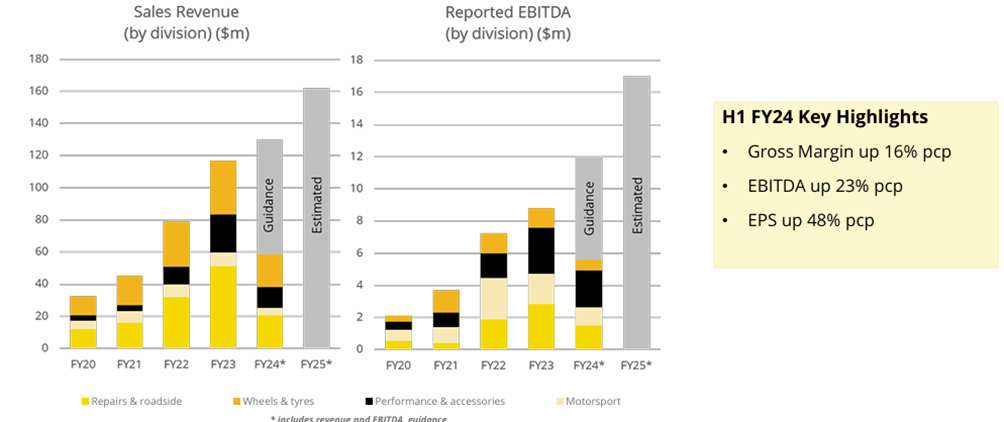

While the RPM business has been profitable and growing (albeit mostly as a result of acquisitions), the roll-up strategy undertaken post IPO and up to 2023 has resulted in RPM’s debt levels looking excessive relative to its low market cap. The strong acquisition-led EBITDA growth (from $2m to $12m as illustrated below) hasn’t translated into EPS growth, given the large amount of shares issued from capital raisings and to vendors of the acquired business over the years.

Notwithstanding the historical growth in the business and the continued strong growth targetted for FY25 (revenues of $160m+ at ~10% EBITDA margin), RPM’s share price has fallen heavily over the last 3 years (from a peak of 45c to close to 6c currently)

With limited market interest in small companies with debt, sentiment towards the stock is particularly negative, but at close to $15m market cap, we consider RPM to be very much over-sold relative to its improving prospects. We believe there is evidence of some encouraging business momentum, that together provide improved confidence in RPM’s outlook:

-A new CEO: Guy Nicholls, became COO in September 2023 and CEO in March 2024. He is well-credentialed, bringing a strong operational skill set to the role, including 11 years as an executive at GUD Holdings (ASX:GUD). We are already seeing results of an enhanced operational focus and improved capital allocation, with some underperforming operations now sold and OPEX being contained, positively impacting gross and EBITDA margins.

-A focus away from acquisitions to internal growth initiatives: RPM have a number of organic growth initiatives they are progressing, leveraging its scale and distribution capability. The most interesting of these growth initiatives is tyre recycling. Since 2022, Australia has banned the export of waste or scrapped tyres, which means currently, RPM has to pay to have its used tyres disposed of. RPM is well progressed in its plans to build and own a tyre recycling plant with attractive economics to enable it to actually profit from selling shreded tyre waste pursuant to off-take agreements, rather than it being a cost. This is a relatively simple mechanical process, shredding tyres sourced from RPM’s network into smaller crumbs and granules. The shredded tyre product can be used as rubberised asphalt for the construction of roads and pavements, and as surfacing for outdoor facilities and playgrounds. If successful and rolled out across the country, this could transform the business into a very strong circular economy driven, organic growth story.

-Improving margins / cash flows / EPS growth: RPM delivered a record half year profit for HY24 (NPAT of $2.2m – up 74%) on the back of improved gross margins and flat OPEX. A renewed focus on working capital and inventory management saw stronger levels of cash generated. Importantly, for the first time in several years we saw much improved EPS growth (+48%). We would ordinarily expect a record profit result to be rewarded by the market with a share price increase, but that was not the case here, with the debt concerns and negative sentiment continuing to weigh on the RPM share price.

-Profit upgrade cycle: On the back of this more focussed and stronger operational performance, RPM announced an earnings upgrade to its FY24 EBITDA to between $11m to $13m (previously $10.5m to $12m). In FY25, Management is ‘targeting’ further EBITDA growth (to between $16m to $18m). While the FY25 target looks bullish to us, the earnings trajectory is confidently positive and, importantly, is now organic driven, rather than acquisition led as was previously. These EBITDA estimates translate to NPAT of ~$4m (FY24) and ~$8m (FY25) – a level of profit that looks attractive relative to RPM’s ~$15m market cap.

-Improved investor engagement: In our experience, companies/management are more likely to engage with the market and investors when there is positive news to tell as there is a natural inclination to want to talk publicly to shareholders about positives/successes than negatives. RPM hosted an investor open day in May providing access to RPM’s senior management and directors and showcasing its product range as well as re-affirming its FY24 earnings outlook. A 72-page presentation was released to the ASX detailing RPM’s growth strategy. We attended the open day and were suitably impressed by the broad range of prospective organic growth initiatives that the company is progressing.

-Sector M&A activity: Bapcor (ASX:BAP) a larger player in the vehicle parts, accessories and equipment market has recently disclosed private equity interest in its business. The proposed offer price for BAP implies an acquisition multiple of ~8x EBITDA, compared to the ~2.5x FY25 EBITDA that RPM is trading on. While it is a much smaller business than BAP, RPM does have a turnover base heading towards $150m and an attractive and sizeable national footprint through its wholesale and retail network, supported by a strong back-end logistics capability. Reflecting this distribution capability, Yokohama has recently agreed to have RPM distribute its tyres in Australia.

We acknowledge RPM’s net debt ($23m post the capital raise) continues to be on the high side, although this debt is backed by significant tangible assets including ~$28m of inventory. We view the $23m net debt as manageable relative to RPM’s FY24 EBITDA guidance (~$12m) and FY25 EBITDA target (~$17m). If debt continues to be a concern, RPM owns some potentially non-core assets which we believe, if divested, could extinguish RPM’s net debt without impacting its revenue growth profile: Revolution Racegear is Australia’s dominant supplier of motor-racing safety gear and performance accessories to motorsport with a market share in excess of 50% and generating healthy profits. Safety Dave, a market leader for many years in specialist safety products for caravans and campervans, such as rear vision systems & tyre pressure monitoring systems, is another attractive business within the RPM portfolio. This business was acquired by RPM for $10m in 2021 and is likely to be worth more than that now. The potential divestment of these subsidiaries (which comprise most of the 30% of the RPM business that is non-tyre focussed) does provide RPM with options if it wanted to strengthen its balance sheet.

After watching RPM from the sidelines since its IPO five years ago, we participated in RPM’s recent capital raising. The funds from this $4m raising will ensure an upcoming expiring convertible note is paid out/rolled over into less expensive debt, and to provide growth capital for the tyre recycling equipment. As always, time will tell if the growth initiatives pay off, but with the stock trading on less than 4x FY24 PE and potentially less than 2x FY25 PE (if RPM meets its stated FY25 targets), investors are essentially pricing RPM as if it is in significant financial distress – we think the signs are there, that, in fact, there is a much stronger profit trajectory emerging and RPM’s debt is very much manageable, or even extinguishable in the event of asset sales.

With a re-focussed business under new leadership that is looking more internally at operational performance and now delivering improved margins, a record first half profit result (clean – no normalisations) and strong forward guidance, we think the market sentiment is overly negative here relative to what appears to be improving fundamentals and metrics. A sentiment change should provide RPM with a strong multiple re-rate from its current low single-digit NPAT multiple, while it has a number of interesting organic growth initiatives, in FY25 and beyond, to drive top-line and earnings growth and improve its debt coverage metrics.

With limited investor interest in sub $100m market cap companies, RPM is one of a number of interesting but very unloved micro-cap opportunities that we like and own in our funds, that have a strong growth profile, a long track record of profitability and that trade on very attractive valuation metrics.

Subscribe to our newsletter