In our previous blog, Findi – A Potential Multi-Bagger, we laid out our Findi (FND) investment case. Since then (December 2023), we have taken up our options, and the share price has more than tripled. As a result, our FND position has become a material holding in the DMX portfolios. Our trip included visiting the TSI head office and a Findi merchant store in Delhi, the TSI operational team in Pune, as well as meeting with investment bankers in Mumbai who were pitching for the potential Indian listing of TSI. We also received high-level presentations from the TSI divisional heads, as well as the TSI CFO and CEO.

Business Overview

Findi is an ASX-listed company that owns approximately 80% of Transaction Solutions International (TSI), an ATM and digital payment business (called Findipay) based in India. It has been operating for several years, but more recently has won large contracts to manage the ATMs for the Central Bank of India (CBI) and a renewal for the State Bank of India (SBI). With a cash injection from its ASX parent and more recently, an investment from Piramal, an Indian Private Equity firm, TSI is now able to take advantage of various organic and non-organic growth opportunities.

The Mumbai Trans Harbour Link

India

Notwithstanding the highly visible poverty, there is real energy in the Indian economy. It is growing close to 7% per annum with major infrastructure projects, manufacturing (reshoring from China), and electrification projects. Coupled with a young and hard-working population, its prospects certainly appear strong. We were able to witness the growth firsthand as we traversed the brand new 22 km long sea bridge in Mumbai (shown below) on our shuttle from Pune. This recent article provides a more in-depth view.

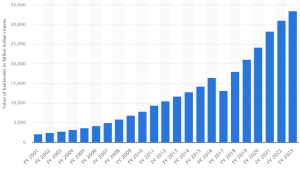

Value of banknotes in billion Indian rupees

Cash Money

One blocker for many investors is the concern that cash is dying. When we spoke to the investment banks in Mumbai, they saw no change in the growth in cash in the years ahead. While digital payment options were certainly prominent in Delhi and Mumbai, cash still rules in rural India with more than 100m Indians unbanked. In line with GDP, Cash in circulation is still growing nationwide. The latest statistics show an acceleration of banknotes since 2018.

TSI Management, the Findi board, Steve, and myself at the New Delhi office

People

A highlight of the trip was getting to hear from the senior management on the ground. We had high-level presentations from the heads of ATM and Findipay, plus the operational heads. A common thread was their pride in their achievements and enthusiasm for the future. We also had plenty of time with the CEO, Mohnish Kumar, who laid out the strategy for the years ahead, and CFO, Deepak Verma, who explained the financial drivers for future profits. I suspect Deepak may have gotten sick of me asking him questions, but he did not show it. Also of note was the hands-on approach from directors Simon Vertullo, Jason Titman, and Nicholas Smedley, who visit India quarterly and are highly engaged and knowledgeable about the business’s operations.

Pune Operations Centre

Visit to Operations Centre in Pune

The recent success of the ATM business has most certainly been due to high-profile wins with CBI and SBI. Management explained the importance of having low outage rates and competitive tenders. Customers will visit ATMs if they have confidence they can get cash out, so reducing the number of outages is critical. TSI has integrated their systems with custom-built software where all parts of the business are communicating and providing actionable data insights. Additionally, with their surveillance system, they can keep costs down and avoid having a security guard at ATM sites. We visited the alert room at the Pune office and saw those alerts being responded to. We also triggered an alert when there were too many people piled into an ATM booth.

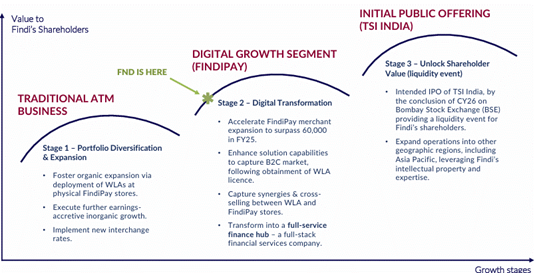

Strategy

To date, TSI India has been focused on servicing bank ATMs (Brown Label). While there are still plenty of Brown Label contracts to be tendered going forward, the focus is now shifting to White Label ATMs and Findipay. The awarding of the White Label license opens significant value uplift by allowing the redeployment of old SBI ATMs. Additionally, there are ready-made locations with the best-performing Findipay merchants as the obvious targets. Having both the ATM and Findipay app available provides a full-service financial hub for customers, allowing them to withdraw cash and use it to digitally pay for products and services, transfer funds to other recipients, and, in the future, access loans and investments. Given its extensive network and platform infrastructure, FND could potentially be engaged by the government to assist in the digital distribution of payments and pensions. This all leads towards the long-term goal of becoming a digital bank, with TSI earning a fee on each transaction. If successful, Findi will be unique with this service proposition.

White Label License

The key to the TSI strategy is obtaining a White Label license, enabling TSI to operate ATMs under its own name rather than on behalf of a bank. This was achieved in April, but they still need a SAR governance audit. Having already achieved ISO 27001 and previously completed penetration tests, this should be completed by October 2024, and TSI will become one of four White Label operators in India. A White Label acquisition has also been flagged as a potential outcome in 2024. Obtaining the SAR governance will also be required for this acquisition.

The travelling group outside a Findipay merchant in Delhi

Findipay

India has a rural population of over 900m, a large proportion of which has only limited access to the banking system and financial services. To help provide digital banking solutions to this under-banked population, FND is targeting the onboarding of 60,000 merchants onto the Findipay digital payments platform by FY25 (currently 28,000). These merchants, located throughout the regions of India, once connected to the Findipay platform can offer the Findipay product suite to its customers. In addition, many people in India have migrated from rural areas to big cities to find higher-paying work and are sending savings back to their families. This is also where Findipay comes into its own. A big city customer can visit a Findipay store and have their cash sent digitally back to their home village. In the home village, there may not be an ATM, so funds can be withdrawn from a Findipay merchant. Findipay merchants are responsible for the cash and prepay their Findipay account, so Findipay takes no risk. The merchant, Findipay, and the switching provider all take a margin on the transaction.

Indian IPO of TSI

A particularly interesting part of the Indian visit was having two mid-market Indian investment banks present on Indian capital markets and the Indian economy as part of a pitch for the mandate to list TSI on the Bombay Stock Exchange (BSE). TSI’s intended IPO on the BSE, scheduled for the calendar year 2026, is intended to provide liquidity for FND shareholders. Both investment banks highlighted the potential for a substantial premium to FND’s current multiple to be achieved on an Indian listing. This is consistent with the experience of other Indian companies (or subsidiaries of multinationals) that have been listed in India after being previously listed on other global exchanges.

Findi Growth Stages

The multiple for TSI that will be achieved on listing will depend on how successful TSI is at growing its Findipay business over the next two years and transitioning from being a pure ATM business. A traditional ATM business would likely list on a sub 10x EBITDA multiple. However, TSI aims to have 30% of its revenue coming from Findipay by the time it lists, which, if achieved, will put TSI well on its way to becoming a unique, full-stack digital financial services company. Indian fintech businesses are currently trading at 20x-30x EBITDA multiples, a significant premium to the ~6x EBITDA that FND is trading at. Based on its current trajectory, we believe FND could be generating $50m+ EBITDA by 2026.

Catalysts

While FY24 was a busy year for FND, FY25 could be just as eventful with multiple catalysts driving value:

• We expect FY25 EBITDA guidance in the next few weeks.

• The acquisition of a White Label operator has been flagged for FY25.

• Full White Label approval (including SAR) around October 2024.

• Increases to the interchange rate after the election source.

• More Brown Label deals.

Summary

There is nothing like having boots on the ground when investing in a foreign country, and India is certainly very different from Australia from a cash and payments perspective. The trip enabled us to gain an appreciation for the ATM and payments landscape. The FND directors, along with TSI management and team, were proud of what the business has achieved to date. There was excitement about the numerous growth opportunities the business has ahead of it, with the team very much focused on having TSI successfully list on the Bombay Stock Exchange in 2026.

Subscribe to our newsletter