Advanced Braking Technology Ltd (ABV) provides aftermarket braking solutions predominantly in relation to underground mining vehicles, but also to the defence, civil construction and waste management industries.

While on the surface this seems like a relatively niche market opportunity, there are some key reasons why a customer would purchase an ABV braking system:

1. 100% fail-safe solutions that protect against unintended vehicle movements.

2. The ABV sealed brakes are better for the environment by eliminating dust emissions – typically 25% of all vehicle emissions come from the brakes.

3. The system leads to reduced maintenance on brakes and wheels delivering cost savings and efficiencies.

The Toyota Land Cruiser is preferred in the mining industry for transporting individuals, maintenance crews, equipment, and emergency response teams. This vehicle has a well-established reputation for its durability and reliability. The Landcruiser comes with standard brakes, but miners chose to install the ABV solution, as the original equipment manufacturer (OEM) brakes installed in the vehicle are ill-suited for underground mining operations. Standard brakes can compromise safety and lead to frequent and costly maintenance. The brakes were never intended to withstand the highly corrosive and abrasive conditions of the mining environment.

Customers include all the major blue chip mining companies such as BHP, Rio Tinto, Glencore, Newcrest and Newmont. They are long-term users of ABV’s braking solution because it is safer, reduces damage, and requires less maintenance.

Financial History

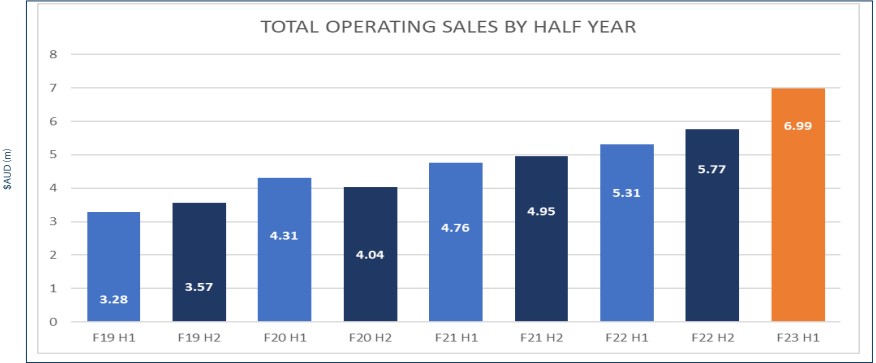

While ABV has been listed since 2006, until recently its financial results have been underwhelming. However, since 2020, ABV has been delivering growing revenues and more consistent cash flows. This pleasing progress has continued into FY23 with revenues year-to-date up 20%, while NPAT is already double what was achieved in FY22. The company has net cash of $2.4m which should be ample for working capital commitments.

Business Quality

ABV’s business is niche with only one major competitor, US-based, Ausco, – as a result, gross margins are decent at ~50%. There has been significant spend on IP over the years and, given the niche nature of what they do, we wouldn’t expect new entrants into the space. However, the business is exposed to mining expenditure and in particular underground mining minerals such as gold, nickel, copper, and zinc so we would expect some cyclicality to their business. Unlike the previous downturn, the increasing recurring revenues should cushion that cyclical impact to a degree.

Revenue Composition

ABV’s current revenue is split roughly 50/50 between 1) sales of new braking systems and 2) recurring maintenance and consumables. As ABV’s fleet size grows, so does the recurring percentage of its revenue. The domestic international split is roughly 60:40 with international sales typically undertaken through distributors.

Haulage Vehicle Opportunity

In the mining space, ABV has traditionally been focused on selling its solutions to smaller utility-type vehicles that travel underground. ABV is now beginning to focus its attention on a new market – larger heavy-duty vehicles that haul ore from underground. These are expensive vehicles ($1m+), and while trucks from OEMs such as Caterpillar and Sandvik already come with Sealed Integrated Braking System (‘SIBS’) installed, mining companies such as Glencore have been deploying the cheaper Volvo FMX construction trucks that do not have SIBS installed by the OEM. Even allowing for the after-market installation of an ABV SIBS system, the cost of a Volvo truck still be many of $100k’s less expensive than a Caterpillar for the same haulage capacity. This allows for Volvo (and other OEMs) that historically have been limited in their ability to sell to mining companies to offer an alternative ‘yellow truck’ opportunity at a much lower price point, potentially disrupting a previously closed market. Therein lies the opportunity for ABV.

Over the last few months, ABV had been receiving funding from Glencore to develop an SIBS for the Volvo FMX truck. However, Glencore sold its Chilian mine where the trial was to take place. This was unfortunate and ABV is now looking to other partners to commercialise the SIBS wheel. The opportunity here is enormous, but getting a commercial outcome is still uncertain.

Tailwinds

We see two significant long-term trends that should keep ABV busy over the years ahead.

ESG – With a social licence to operate becoming more important, the safety and brake dust avoidance benefits of the ABV solution have been embraced by the largest miners. Many of these miners are global and are now adopting the ABV solution in other jurisdictions where they operate, where ESG and safety considerations are becoming increasingly in focus.

Underground Mines – With a scarcity of suitable above-ground new mining sites, more and more mining is occurring underground. Whatever vehicles are used, these are harsh environments operating in steep, dangerous declines, which lend themselves to the ABV solution.

Management and Board

The company has a reasonably new CEO, Andrew Booth. Andrew was first bought on as a Director of Strategy and Commercial in early 2021 before moving from an acting CEO to permanent CEO role in 2022. Since then, revenue growth has been robust across both Australia and internationally with improved margins and profitability. While Andrew has some out of the money options, we’d prefer to see him have more substantial equity ownership. ABV has a small board with only David Slack (with 19.82%) having significant ownership.

Valuation

We think ABV’s current earnings profile can easily justify its current valuation. FY23 EBIT is likely to be ~$1.6m and on an EV of $13m, this puts ABV on an EV/EBIT multiple of 8x. ABV won’t pay tax for some time, due to previous years losses, so NPAT closely matches EBIT.

While the business is cyclical and small, it has some attractive features: it is growing nicely, particularly its more recurring maintenance and support revenues, and is a market leader in a niche space, with significant IP developed over 20 years, and relationships with most of the major global miners. It has some clear tailwinds as miners focus on safety and ESG concerns. It currently sells brakes into 40+ countries with further expansion of its global footprint planned.

With a strong net cash position, and on a sub 10x PE multiple, we believe its current share price undervalues ABV by a significant margin.

We think XRF Scientific (XRF) has a similar capital and recurring component to the business with specialised IP. XRF sells one-off capital equipment to miners for sample preparation and then sells consumables which are recurring. This is quite similar to the ABV model where the brakes are sold, then maintenance and consumable are consumed over the lifetime of the capital equipment. XRF trades on EV/EBIT multiple of 13x compared to ABV at 8x and a PE Multiple of 20x compared to ABV at <10x. Both have similar organic growth profiles.

We think the current valuation provides a margin of safety in our investment, but we consider the payoff quite asymmetric if the SIBS strategy gets commercialised at scale.

Summary

Companies with poor track records provide opportunities as it takes a while for the market to trust that the turnaround is real, particularly in relation to small companies. In ABV’s case, we now have two to three years of improved performance and a new CEO achieving success through executing on his strategy of expanding relationships with new and existing customers while having a profit focus. With its larger, and growing, recurring revenue base, strong tailwinds and the SIBS opportunity, we are confident that the future is bright for ABV.

Subscribe to our newsletter