An investment company managed by

DMX Asset Management Limited

ACN 169 381 908 AFSL 459 120

13/111 Elizabeth Street, Sydney, NSW 2000

DMXCP directors

Roger Collison, Dean Morel, Steven McCarthy

Opening NAV (30 Nov 2025)

$2.8429

Closing NAV (31 Dec 2025)

$3.0182

Fund size (gross assets)

$36m

% cash held - month end

2%

1-month return

6.2%

1-year return

27.7%

3-year return (pa.)

14.2%

Since inception (10 years 3 month ) (pa.)

16.5%

Since inception (10 years 3 month )

417.4%

Dear Shareholder,

DMXCP’s NAV increased 6.2% (after all accrued fees and expenses) for December 2025. The NAV as at 31 December 2025 was $3.0182, compared to $2.8429 as at 30 November 2025. During December the All-Ordinaries Accumulation Index increased 1.3%, the Small Ordinaries rose 1.2%, while the Emerging Companies Index was up 10.1%.

December Developments

The highlight in December was the CY25 profit guidance from EDU Australia (ASX:EDU) of ~$14m NPAT – higher than previously forecast due to enrolment growth and high retention across Ikon’s higher education courses, and strong second half cost control. EDU’s share price finished the month up 33%, having risen ~ 850% during 2025. Having started the year with a market cap of just over $10m, EDU passed though the $100m mark in December – highlighting the real opportunity from low market cap opportunities that we are trying to capture.

We also saw a significant contribution from Verbec (ASX:VBC) which was up 48% during December following completion of its accretive acquisition of Alliance Automation from Telstra, and confirmation of contract wins and strong momentum in its core business of energy transition engineering.

With a more risk-on investor appetite, we also saw some strong share price movements in some of our smaller positions – RMA Global (ASX:RMY) was up 52% while 8Common (ASX:8CO) was up 48%. In terms of detractors to the portfolio for the month, the material one was General Capital (NZX:GEN) which was down 10%.

Thoughts as we enter 2026

Having finished 2025 on a positive note, we look forward to 2026. We are hopeful that the resurgence of interest in Australian micro-caps that we experienced in 2025, continues through 2026. While we are cautious on global markets, we believe there remains plenty of value on offer in the smaller end of the Australian market, with lots of opportunities for re-rates. Our portfolio is highly weighted to a number of these compelling, under-the-radar opportunities, with attractive growth profiles many that are often trading on single digit price earnings multiples.

In a recent end of year “Investor Roundtable” interview for the Under the Radar Report (UTRR) newsletter, we were asked to nominate which three companies we were most excited about for 2026. We are long term focussed investors, so trying to predict shorter term winners is an exercise that often leaves us with some egg on our face. In fact, in a similar end of year interview last year, two of the three companies that we selected for UTTR to do well in 2025 delivered negative returns for the year (although our one positive nomination was EDU which has had a strong re-rate in 2025). The three names that we have nominated this time in the UTTR interview that we are particularly excited about for 2026 – AER, VPR and VBC – are discussed below. While VBC began to re-rate at the end of 2025, these are all under-the-radar businesses with low market caps that we expect to grow strongly in 2026.

Aeeris (ASX:AER)

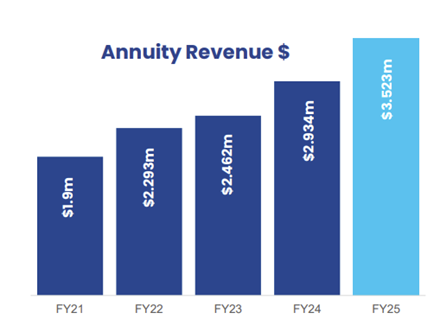

AER is a meteorological data company that helps its customers make informed climate-related business decisions, receive weather alerts, and understand potential climate risks. Typical customers include insurance and transport companies and government agencies. There are strong structural tailwinds for AER’s products, with the cost of severe weather in Australia now exceeding $4.5b annually and driving demand for accurate, real-time climate risk intelligence. AER has been listed for a number of years and (as illustrated below) and, while it has consistently grown its ARR at a double digit rate since 2020, it has yet to generate a profit. In recent years, AER has made a significant investment in its next-generation weather intelligence platform that strengthens its ability to deliver accurate, real-time hazard insights to enterprise, government, and insurance clients. On the back of this R&D investment, and strong operating momentum (ARR year to date is up 10%), we believe FY26 should be AER’s maiden profitable year.

With sticky, annuity-style revenues and ~20–30% revenue growth, compelling IP and tailwinds, imminent profitability and currently trading on 1x ARR, we believe there is potential for a significant rerate off a very low EV of just $4m at 7.1c at 31 December 2025. DMXAM is a substantial holder of AER, having recently increased our position here to 13% of the company. We own a similar company Asset Vision (ASX:ASV) (in terms of revenue, growth profile, balance sheet and customer base), but which has stronger investor recognition and acceptance. After more than doubling during 2025, ASV now has a market cap of $30m – a five times uplift on AER.

Volt Group (ASX:VPR)

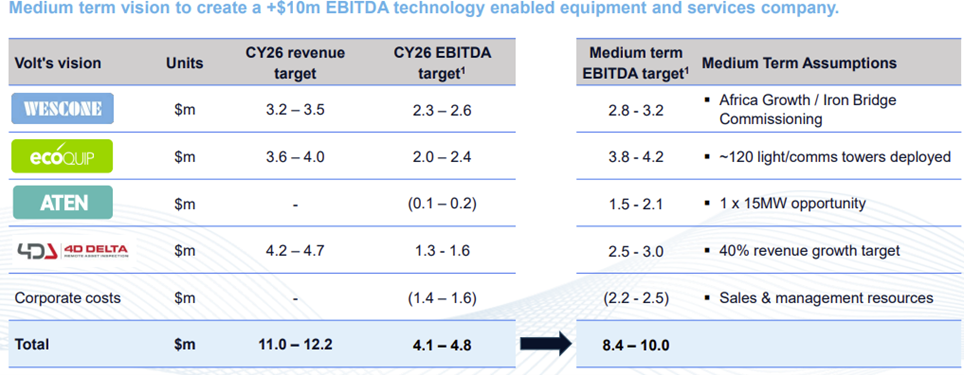

VPR owns a portfolio of businesses that provide proprietary mining equipment and software solutions that reduce operating costs for mining clients. Led by former Pacific Energy CEO Adam Boyd, we recently established a position here cornerstoning a placement supporting the acquisition of 4D Delta, an equipment-monitoring solution using LiDAR and proprietary software. Volt was already profitable, but this acquisition adds scale and earnings diversity. Based on Management’s FY26 EBITDA targets, we estimate an NPBT of over $3m on an EV of ~ $20m, which appears modest for a growing, IP-rich technology business.

Verbrec (ASX:VBC)

VBC is a national engineering and infrastructure services business with a focus on energy transition. Since his appointment in 2023, ex-Sedgman CEO Mark Read has delivered an impressive turnaround, emphasising profitable contracts and selling non-core assets at attractive prices. The recent acquisition of Alliance Automation expands VBC’s capabilities in automation, digitisation, machine learning and cyber security, enabling the company to deliver services across the full asset lifecycle and across a broader range of industries. VBC trades on a single-digit earnings multiple, which we believe significantly undervalues the business given its scale, diversification and national footprint. We note that since we drafted this summary for UTTR in early December, the VBC share price has increased ~50% through December, but we continue to like the upside here.

As we move into 2026, we have a broad mix of long-held and recently added investments, many of which we see as having meaningful upside in the year ahead. As we have experienced with EDU this year, we continue to believe in the opportunities from investing in unloved, under-the-radar businesses that have strong growth profiles and attractive valuations.

We look forward to 2026 and seeing our portfolio of companies continue to grow and add value.

We thank you for your continued support and wish you all the best for 2026.

Subscribe to our monthly report

Each month we provide a commentary on news across our portfolio and drill down on specific companies of interest.

We’re proud to share our insights with a range of subscribers including current investors, prospective investors, private investors, and industry friends.