A wholesale unit trust managed by

DMX Asset Management Limited

AFSL 459 120

13/111 Elizabeth Street, Sydney, NSW 2000

Trustee & Administrator

Fundhost Limited AFSL 233 045

Unit price (mid) based on NAV (30 Nov 2024)

$1.2155

Unit price (mid) based on NAV (31 Dec 2024)

$1.1791

Number of Stocks

46

% cash held - month end

2%

1-month return

-3.0%

12-month return

19.2%

Since inception (1 March 2021) pa

8.1%

Fund size (gross assets)

$13m

Dear Investor,

DMXASF’s NAV declined 3.0% in December, reversing some of its strong November result. The broader market

was mixed with the ASX Emerging Companies Index flat at -0.1%, while the ASX 200 Accumulation Index was

down 3.2%. Calendar 2024 was strong for us, up 19.2% versus 13.7% for the Emerging Companies Index and

11.4% for the ASX 200 Accumulation Index.

Commentary

The month was mixed in terms of both developments and individual stock price action. Frontier Digital Ventures

fell 14% following an update on its previously-announced strategic review. Its effective non-update, we think,

came across a little desperate. We’ll need to see how this one plays out over the next few months and note this

is now a relatively small position for us. EML Payments declined 17% following the surprise departure of its new

CEO, Ron Hynes (discussed below), while Medadvisor fell 27% following yet another negative update. Other

holdings fell for no fundamental reasons, with Findi further de-rating, down another 20%, Pureprofile down

15%, and NZ-listed General Capital down 36% (also discussed below). Findi remains our largest holding in the

5% position size range, and with both its share price and sizing coming off, we’re increasingly comfortable here.

These declines were somewhat offset by meaningful gains elsewhere. Each of Energy One and Raiz rose 22-23%

while Sequoia recovered 13% and Austco continued its ascent, up 10%. Our returns from each of these have

been enhanced through having added at lower prices. In the case of Energy One, we added to our holding via its

rights issue last year at much lower prices; a small position in Raiz was re-introduced also in 2024; Sequoia was

added to in the low-30c range in November; while we added to our Austco stake via the sell-down of a former

director in September. In addition to capturing dividend income and longer-term capital gains from our holdings,

we also aim to enhance returns and manage risk through opportunistically re-positioning in response to changes

in prices relative to our ongoing assessments of individual holdings.

In terms of activity for the month, we completed our sales of RPMGlobal, closing out what’s been a profitable

investment. We continue to rate the company and its prospects, but we simply need capital to pursue the even

more prospective opportunities we face. These funds have been set aside to help fund an underwrite of a small

option exercise for Senetas Corporation. Senetas is a DMX Capital Partners holding that we’ve not held at

DMXASF up to this point due to liquidity constraints. Our opportunity to help underwrite this option exercise

has provided that needed liquidity to establish a 2% position for the Fund, while also adding to our holdings for

DMXCP. Elsewhere, we’d expected additional proceeds from Tambla’s business sale and capital return

programme, but this has been deferred into the new year.

Select Stock Updates: EML Payments & (NZ-listed) General Capital

As noted above, EML Payments declined following the departure of its new CEO. Having joined the business less

than six months earlier the Board terminated Hynes’s employment just before Christmas citing the need for

alternative leadership to execute the company’s newly adopted EML 2.0 strategy. While never nice news to

receive, it’s important to take a balanced approach in re-assessing companies in these situations. The CEO was

very new to the role and the Board has decided he’s not the right guy for the role. It would be much worse to

keep the wrong person in place, though the impact from the latter wouldn’t be felt until well into the future, if

at all. EML has made clear strides in its turnaround, as we reported last month. Non-core assets have been

divested, the business is re-focused on growth in addition to reducing costs, and valuation metrics are attractive.

In a global payments landscape, we believe EML may be appealing to a number of strategic or financial acquirers

and with its patchy past and wide-open register we wouldn’t be surprised to see corporate activity here at some

stage.

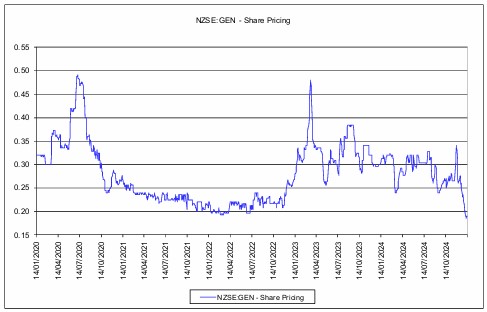

In the case of General Capital, this small and illiquid company’s shares have suffered for the market having to

absorb a couple large parcels recently. We initially invested in General Capital in 2022 in the low-20c range (post

consolidation). We’d been sellers into strength as the shares subsequently re-rated, and have otherwise been

patient and supportive shareholders with our remaining small position (around a 2% weight). The company has

made great progress, expanding its loan book and operating prudently in its niche as a second-tier first mortgage

lender. As a micro-cap in the $20-30m market cap zone, tightly held with the top four holders (including its CEO)

owning around 80% of the company, the shares are thinly traded and – as per the below 5-year chart – have

been quite volatile. This volatility isn’t reflective of its underlying fundamental developments or our ongoing

assessment of value, which have been quite positive and steady.

We learned in early December that a vendor (which we presumed was a former director) was seeking to sell

some shares. Then in the high-20’s, we sat patiently on-screen with a low-ball offer at 20c. Over some period of

time, we believe the low-ball offer in volume, together with perhaps word spreading that there was a large

volume, saw the share price inch closer to our bid. The shares ended the month down 36% at 21.5c, and in early

January the vendor capitulated, selling into our 20c bid. We subsequently bid lower still, eventually dealing on

market for more at 18.5c. We’ve taken this opportunity to move the DMXASF holding from just over 1% to nearly

3%, and have initiated a position for DMX Capital Partners at these levels. For context, the company’s net asset

value is closer to 30cps and we expect EPS of 4-5c for the year ahead. If the company continues to execute we

believe this could be a comfortable double over the next 2-3 years.

Summary

Having now absorbed material de-rates to the likes of Findi, and other key holdings having deflated, we’re

enthused about the embedded value in the portfolio, and the breadth and diversity of the opportunity set to

which we’re exposed. Key holdings that have performed well have done so deservedly, and remain prospective

for the portfolio. With a rich vein of new opportunities, we continue to look to our most marginal positions as a

source of liquidity to help fund these.

Thanks very much for your trust and support.

Subscribe to our monthly report

Each month we provide a commentary on news across our portfolio and drill down on specific companies of interest.

We’re proud to share our insights with a range of subscribers including current investors, prospective investors, private investors, and industry friends.