Overview

Raiz Invest (RZI:ASX) is one of Australia’s leading wealth technology companies, offering an innovative platform that allows customers to start investing with as little as $5. It provides its users with a diverse range of investment options, including ETFs, Bitcoin, and Australian residential property funds, Raiz Invest managed over $1.46 billion in funds and served 309,953 active customers as of August 2024.

RZI has a high customer satisfaction rate and strong ratings on both the Google Play Store (4.5/5) and the Apple App Store (4.8/5). The research house, Yougov1, performed a survey in 2022 that indicated Raiz was the number two micro investing app by awareness in Australia.

Its product portfolio includes Raiz Invest, Raiz Rewards, Raiz Kids, Raiz Super, and Raiz Plus, catering to different financial needs and goals.

Product Suite

• Raiz Invest: Offers eight ready-made investment portfolios, or the option to create a customizable portfolio.

• Raiz Rewards: A loyalty program that allows users to earn cashback from purchases with partner brands, boosting their Raiz and Super balances.

• Raiz Kids: A straightforward way to invest for children under 18, enabling them to have direct access to their investment portfolio with parental permission.

• Raiz Super: A unique superannuation offering, including exposure to the Australian Residential Property Fund, and the ability to set up SMSF accounts.

• Raiz Plus: Allows customization of investment portfolios, including standard portfolios, ASX stocks, ETFs, residential property funds, and Bitcoin.

History

Raiz Invest’s journey has been challenging. Originally launched as Acorns Australia in 2016—a collaboration between Acorns Grow, Inc. and Instreet Investment Limited. —the company underwent a significant transformation in 2018. Following a buyout of Acorns Grow’s share by the Australian team, the company rebranded to Raiz Invest and IPO’d in 2018.

The subsequent years saw an ambitious, yet costly expansion into Indonesia and Malaysia, spearheaded by former CEO George Lucas. These ventures resulted in substantial losses, with the Indonesian exit now complete and the Malaysian market exit expected later this year. Amidst these challenges, George Lucas stepped down, and Brendon Malone took over as CEO, shifting the focus back to the core Australian market.

Under Brendon’s leadership, Raiz has achieved notable milestones, including NPAT profitability in the most recent half-year. His strategy revolves around:

• Driving ARPU (Average Revenue Per User) higher

• Cost control and cashflow positivity

• Leveraging partnership-driven growth, tapping into a 300k-strong investor base that others are keen to access

• Expanding Raiz Rewards to boost customer engagement

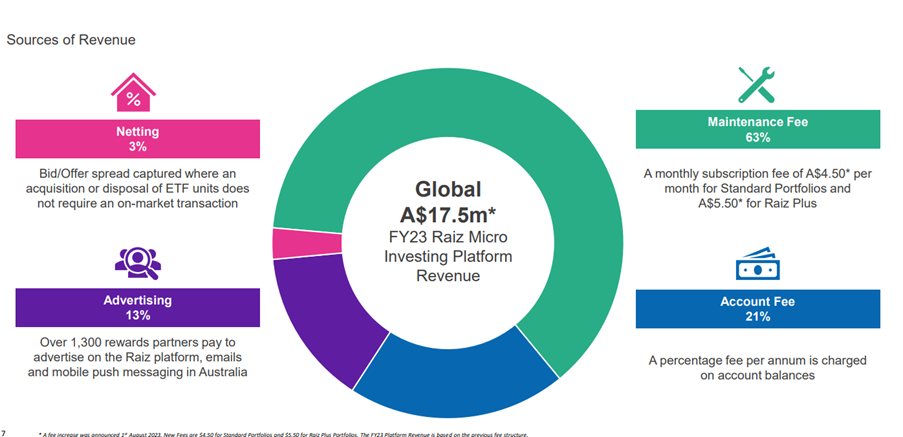

How does RZI make money?

Raiz has diversified sources of revenue, but the primary driver remains the monthly subscription fee. This predictable revenue stream sets them apart from traditional fund managers, who are more susceptible to market volatility. With a solid gross profit margin of ~70%, the company has a stable revenue base, ensuring resilience in various market conditions.

Levers for Growth

While active user growth has been muted, we see some key levers for to change:

• Partnerships: Collaborating with targeted groups to unlock cross-selling opportunities such as the Ladies Finance Club, enhancing Raiz’s market reach and brand.

• Re-engage Inactive Customers: Introducing innovative products to attract and re-engage users. The addition of residential property investment, individual shares, and a broader selection of ETFs, such as those offered by State Street. Raiz currently has 1.2m users who have signed up but not invested or have stopped investing.

• Expanding Product Offerings: Introducing annuity products, in collaboration with State Street, to diversify the investment options available to customers and open a new demographic

• Enhancing Raiz Rewards: While Raiz Rewards is a valuable offering, there is a need for increased user education to fully leverage its benefits and maximize engagement.

Is FY25 the Inflection Point to Profitability?

With 2H24 showing profitability, we anticipate that FY25 will be a pivotal year for Raiz. We project a potential positive NPAT of $1-2 million in FY25.

Key drivers include:

• Price Increase: A $1 price rise was implemented last August for over 300k users, with 100% of the additional revenue contributing directly to NPAT.

• Reduced Marketing Costs: Lower marketing expenses as the Channel 7 contract comes to an end.

• Subscriber Growth: At current run rates, an estimated 1530,000 new subscribers could be added in FY25 which would $21 million to revenue at a 70% gross margin.

• Upselling Opportunities: Further upselling from existing customers, transitioning from basic investment products to Super and Raiz Plus.

Medium Term Drivers

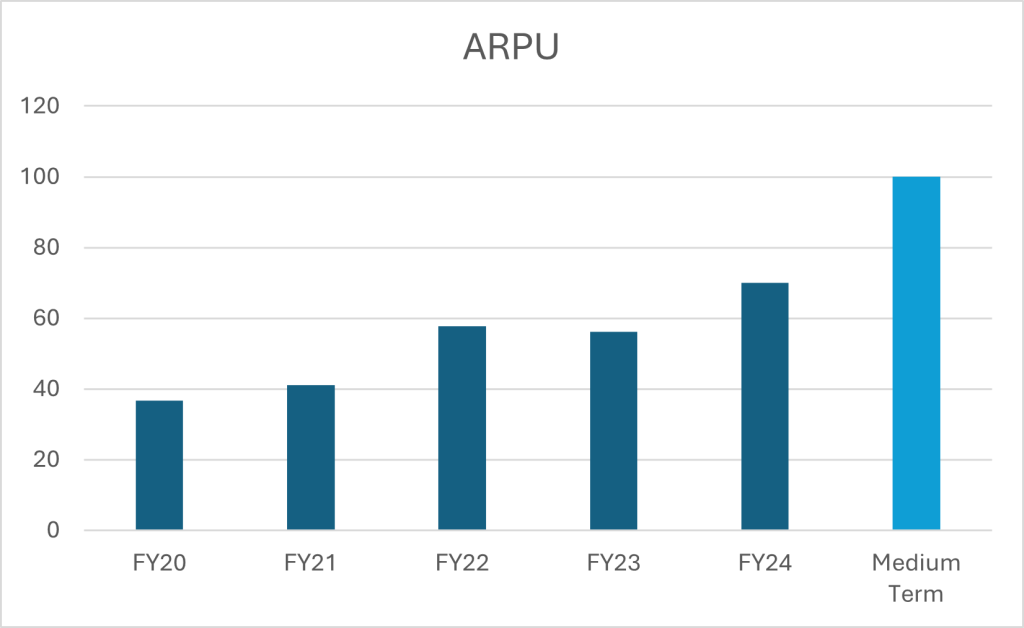

In the medium term, we see continued potential for increased ARPU. Q4 FY24 saw ARPU rise to $72, and CEO Brendon Malone envisions reaching $100 ARPU in the medium term. Historical data shows price increases in FY22 and FY24 driving ARPU growth.

A big chunk of that increase could come from another price rise adjustment in FY26, which could bring ARPU closer to the $100 target. Even a modest $1 per month increase across the 300k 314k customer base would translate to an additional $3.6 76 million in net profit.

Why is RZI Out of Favour?

It has been tough investing in Raiz with the share price bumping around all-time lows.

There are several possible reasons why Raiz has fallen out of favour with the market:

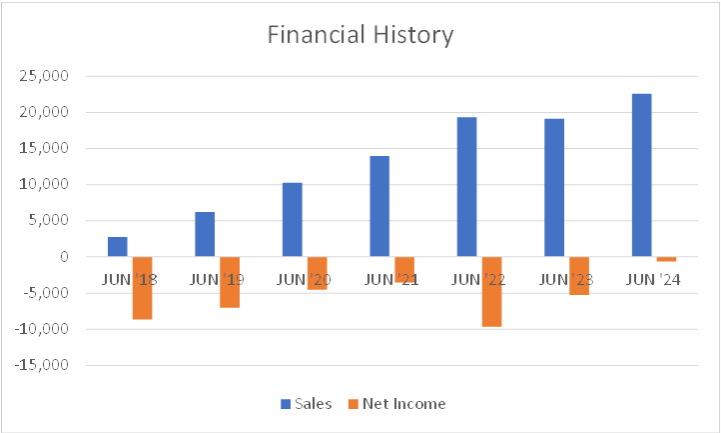

• Losses: Despite years of revenue growth, losses have been heavy and until FY24, operating leverage was not evident.

• Market Focus: We think the market has been overly fixated on muted user growth numbers instead of the impressive revenue growth and rising ARPU. However, with the recent Q1 update, we are starting to see an increase in growth.

• Previous Failures: The shadow of previous setbacks in South East Asian ventures, continues to linger, despite these divisions being sold.

• Boardroom Turbulence: Past board-level disputes and instability have left a negative impression, although these issues have now been addressed.

• Cum Raise: The balance sheet requires regulatory capital of circa $5m. Prior to the recent capital raise, there may have been concerns that a discounted raise may be required. In fact, the recent State St transaction was undertaken at a premium to the current price.

Peers Getting Taken Over

One of Raiz’s closest peers in the market is Spaceship. Recently acquired for $80 million, Spaceship boasts around 200,000 customers and $1.5 billion in Funds Under Management (FUM). This acquisition by eToro highlights the interest in the micro-investing space and the potential value on offer for considering Raiz’s current market capitalization of $45 million (including approximately $14 million in cash) and near term profitability.

Conclusion

After a challenging couple of years, we think RZI now represents an interesting investment opportunity. With the distraction and losses from RZI’s Southeast Asian ventures now behind them, Management is focused on growing and further monetising its strong Australian customer base. The company has recently transitioned to EBITDA profitability, and we expect it to report its maiden NPAT in FY25. RZI is already demonstrating strong operating leverage, and any future monthly price increase across its customer base has the potential to supercharge its profits.

We are enthused about the opportunity for Raiz Invest to emerge as an NPAT profitable fintech playing an important role in the investment journey and financial education of over 300,000 Australians.

1.Micro-investing in Australia: what’s driving take-up & how do major investment platforms compare? | YouGov

2.Mike Cannon Brookes-backed Spaceship acquired by eToro in $80m deal (afr.com)

Subscribe to our newsletter